Disliked

I used to be a 'aim-less' trader, looking at various trading systems at the same time, and overload with fundemental information that my little brain cannot cope. Though Price Action is not new to me, it is only with Strat's thread and his strong conviction that I finally manage to stick to only 1 system - PASR.

Ignored

Last time, I used to look at charts and search for all possible entry points to put in trade. I will look at all the different candle patterns that indicate a possible 'reversal' trade. The little brain will tell me to go for these trades as the returns are higher, as trend cannot go on forever. Though I have SR and Fibo levels on the chart, these doesn't help much as most of time, I'm trading against the trend.

After some serious fight with the grey cells between my ears, I did a 180 degrees turn in looking at charts. These are what I learnt :-

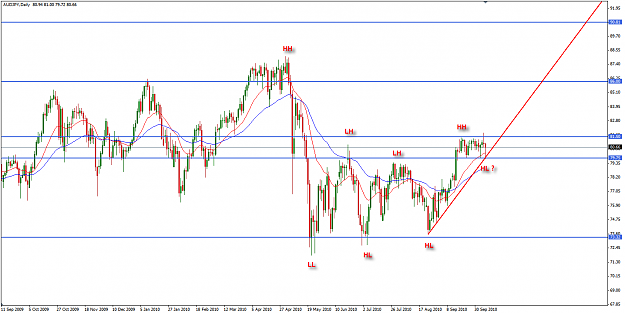

1) Look at multiple time frame (W, B and BB) to determine the trend.

2) Do not trade when the pair is not trending.

3) Trade along the trend... counter-trend trades are much more difficult to execute.

4) Look at candle patterns around SR lines to determine the entry point.

5) Look at candle patterns relative to where it appears on the chart.

A very good example will be the USDJPY pair in the last few months, in my old self, I will go Long this pair in all possible reversal situations, thinking that it cannot go any lower. With the help of this thread, I'm can see the bigger picture much clearer and don't stand in front of the rock that is rolling down the slope.

Hope my personal experience will help more people in this thread.

Still learning,

AT