Dislikedwhat

...

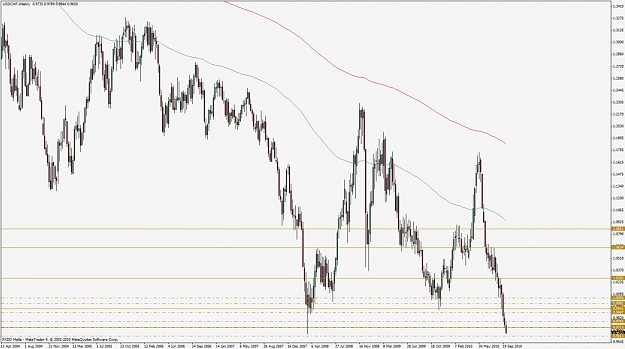

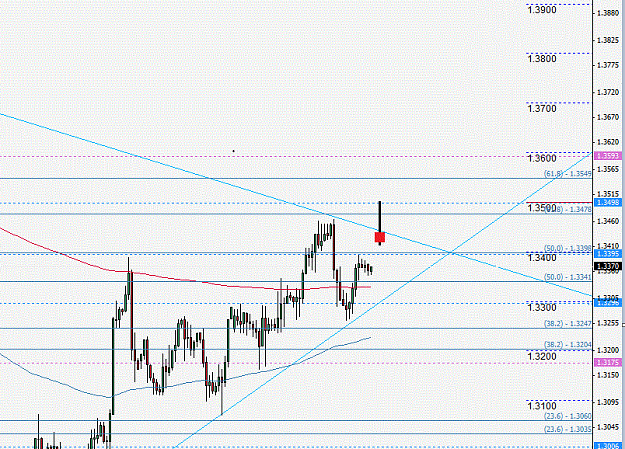

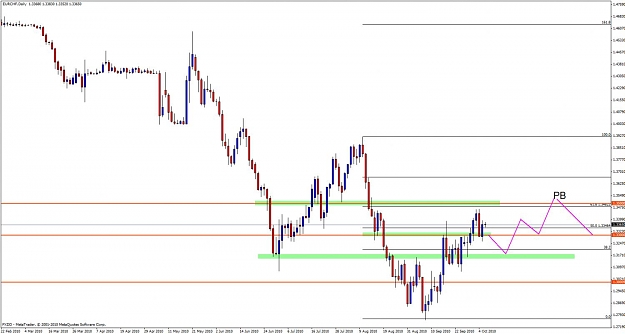

(an alternative: use this indicator to plot lines, then just discard the other lines which u think are unnecessary. adjust the other lines, if u deem necessary. this way, u plot your PPZs, S/Rs much faster, time-wise.)Ignored

the lines created by the indicator will stay on the chart even after u deleted the indicator.

sharing it here, just in case..

Attached File(s)

i think i've seen that indicator on the MQL4 forum before.