DislikedHi Kalvind,

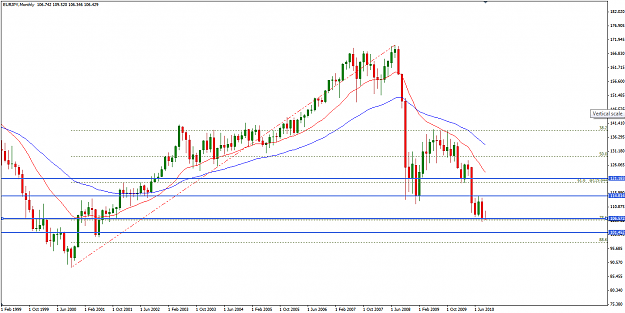

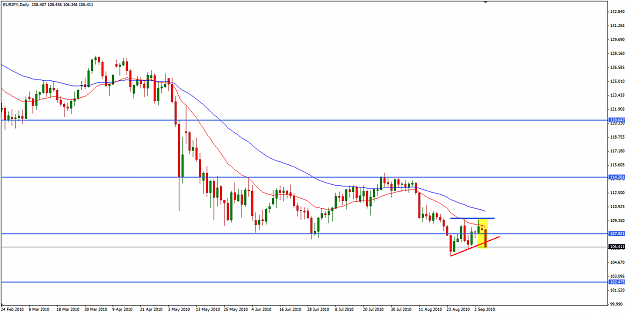

For me if the price of the next bar(s) to the controlling candle has gone higher or lower then the controlling candle's high or low whether it closed or open higher or lower then controlling candle has lost its control.Ignored

I agree that the controlling candles have been breached BUT have not closed above/below of this candle? For me a safe entry would be when there is a close above/below the controlling candle with PASR. Good luck with your trade.