DislikedI think he means the equivilant of your global kill switch. It means an emergency stop to close all orders and keep you from "losing your shirt". Probably a Hopwood term.QuoteDislikedShirt protection, what's that?Ignored

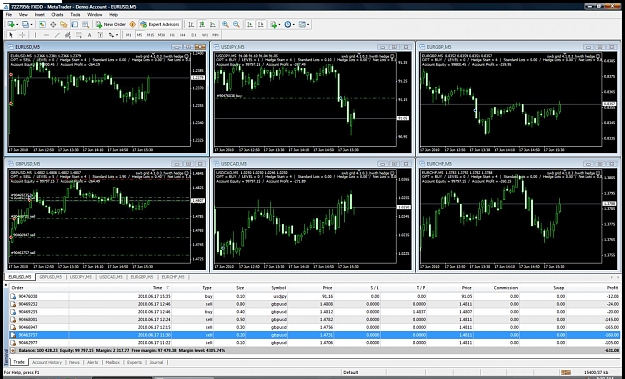

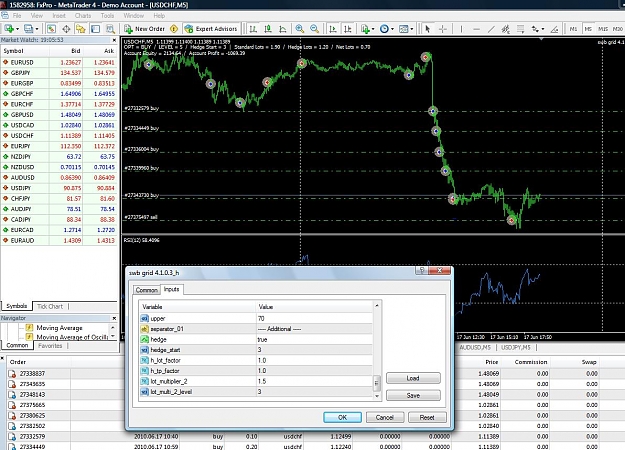

QuoteDislikedHas anyone thought about opening on 3 or 4 pairs at the same time, not too closely correlated, of course, and closing all trades at once when there is acceptable profit over loss? You would be accepting a lot of losers too early and leaving some money on the table. But, should be able to get an overall steady profit.

Attached File(s)