Acually Im short GBPJPY at 202.41

One hour tunnel method 2 replies

Tunnel Vision. Independent Signals & Positioning Recommendations. 189 replies

4 hour tunnel confusion 8 replies

I am confused about all the different Tunnel methods out there...Clarificatio n please 3 replies

Questions re: MT4 and VWB 1 Hr Tunnel 0 replies

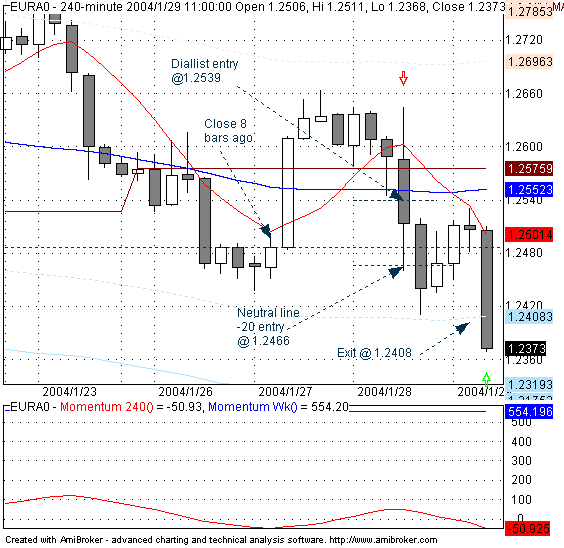

Quoting diallistDislikedI've done a partial backtest for the second period. I got 2469 pips just through March 9th. Just eyeballing the charts I can see I would get more through the end of the sell cycle at 5/21/04. I would have done the whole period but I've got inlaws wanting feeding so I've got to go. I did this kind of quickly so be wary of any errors I might have made.

Are you taking both primary and secondary signals? If you take just the primaries, you'll miss out on a lot of pips.

FYI, I entered my "trades" 20 pips beyond the neutral line, and exited either when a fib level was hit or price moved 20 pips beyond the neutral line in the opposite direction.

DialIgnored

Quoting firehorseDislikedHi,Thanks for your reply.

I was taking both primary and secondary trades. Entry at close of 4hr bar at the close price. I was hoping to duplicate the original results without any tweaks.

I'll have a look and put the tweak of +/-20 from the neutral line and report back.

Thanks again for doing the backtest.

Best regards

AlanIgnored

Quoting xspowerxDislikedI can't seem to get it one good trade on this in the last week.

Gotta keep trying!Ignored

Quoting diallistDislikedP.S. The date of the second trade in the spreadsheet is wrong. It should be 1-28 instead of 1-27.Ignored

Quoting diallistDislikedIt's been a choppy week. Usually is around Christmas. I suspect volume has been low as well. Things should pick back up after New Years. Just remember to wait for the signals before entering rather than anticipating them. Remember to think of your trading as a sniper's rifle rather than a machine gun. Don't shoot at everything that moves. Pick your target carefully, then squeeze off that one shot.

DialIgnored

Quoting xspowerxDislikedThanks for the relief. Its good to know that.

I do enter right when I get the signal and it seems like I've been stopped out on most before. However, when I look back in history it seems to trend perfectly fine. Makes me think its only my luck hahaIgnored

Quoting xspowerxDislikedThanks for the relief. Its good to know that.

I do enter right when I get the signal and it seems like I've been stopped out on most before. However, when I look back in history it seems to trend perfectly fine. Makes me think its only my luck hahaIgnored

Quoting xspowerxDislikedHey Firehorse, I think you missed the new update.

He has a V2.0 out by email to one of our members who kindly shared it with us. It eliminated the calculation of weekly momentum. In my opinion, I think its better.Ignored

Quoting xspowerxDislikedHey Firehorse, I think you missed the new update.

He has a V2.0 out by email to one of our members who kindly shared it with us. It eliminated the calculation of weekly momentum. In my opinion, I think its better.Ignored

Quoting keris2112DislikedHi all,

I've been a member here for a while, but I don't think I've ever posted. I post a lot at other forums and just never quite got around to FF very often. Wow, was that a mistake. You guys are great.

I've been interested in the Vegas method for a few months and I've played around with the indicators by Spiggy and tried making my own adjustments. I'm still in that demo/learning stage of my trading career so this thread has been really enjoyable to read.

I think the thing I like most about the 4 Hour Tunnel is that it is not "gimmicky" to me. Maybe that sounds dumb, but there are so many new "super-duper make-you-rich-in-a-month" strategies out there that it makes it difficult for a new trader to focus on making something work. The 4hr Tunnel seems to just be based on a solid foundation and if it is traded with some discretion, it should be profitable.

Anyway, back to my reason for posting. I've found that if you use a 25 HMA (Hull Moving Average) on the 4hr chart instead of the 8 SMA it gives cleaner signals. The REAL turns happen at pretty much the same time, but because it is so much smoother, it filters out a lot of the "head fakes" that the 8 SMA gives. The 8 SMA tends to make a lot of small "bounces" when there is a small retrace in price causing it to officially change direction (even if by only a few pips and for only 1 bar), which according to the system takes you out of the trade. The 25 HMA smoothes right through those small retraces.

I also found that replacing the 55 SMA on the 4hr with a 233 HMA gives interesting results. It follows the twists and turns of the 55 SMA pretty evenly, but during ranging markets it tends to stay a little further away from price, thus, when you get bounced in and out of the market due to turns on the Short MA, you are only entering with 1/2 positions.

I'm attaching a picture to show you what I mean. The SMAs are the thin lines and the HMA are the thicker lines.

Also, I'm attaching the HMA.mq4 file for Metatrader. You can find more info about the Hull Moving Average at Alan Hull's website under the Articles section (or just Google it). I don't think I'm allowed to post an actual link to a website yet. If you click on the Articles section it takes you to a site where he sells a newsletter. (Lots of good free articles too) I'm not affiliated with that in any way. I just want you to know where to go to find info on the HMA and he gives a full description of it there and shows you the formula.

Well, I guess this is long enough for a first post. Thanks again for a great thread. I look forward to contributing here.

KerisIgnored

Quoting keris2112DislikedHi all,

I've been a member here for a while, but I don't think I've ever posted. I post a lot at other forums and just never quite got around to FF very often. Wow, was that a mistake. You guys are great.

I've been interested in the Vegas method for a few months and I've played around with the indicators by Spiggy and tried making my own adjustments. I'm still in that demo/learning stage of my trading career so this thread has been really enjoyable to read.

I think the thing I like most about the 4 Hour Tunnel is that it is not "gimmicky" to me. Maybe that sounds dumb, but there are so many new "super-duper make-you-rich-in-a-month" strategies out there that it makes it difficult for a new trader to focus on making something work. The 4hr Tunnel seems to just be based on a solid foundation and if it is traded with some discretion, it should be profitable.

Anyway, back to my reason for posting. I've found that if you use a 25 HMA (Hull Moving Average) on the 4hr chart instead of the 8 SMA it gives cleaner signals. The REAL turns happen at pretty much the same time, but because it is so much smoother, it filters out a lot of the "head fakes" that the 8 SMA gives. The 8 SMA tends to make a lot of small "bounces" when there is a small retrace in price causing it to officially change direction (even if by only a few pips and for only 1 bar), which according to the system takes you out of the trade. The 25 HMA smoothes right through those small retraces.

I also found that replacing the 55 SMA on the 4hr with a 233 HMA gives interesting results. It follows the twists and turns of the 55 SMA pretty evenly, but during ranging markets it tends to stay a little further away from price, thus, when you get bounced in and out of the market due to turns on the Short MA, you are only entering with 1/2 positions.

I'm attaching a picture to show you what I mean. The SMAs are the thin lines and the HMA are the thicker lines.

Also, I'm attaching the HMA.mq4 file for Metatrader. You can find more info about the Hull Moving Average at Alan Hull's website under the Articles section (or just Google it). I don't think I'm allowed to post an actual link to a website yet. If you click on the Articles section it takes you to a site where he sells a newsletter. (Lots of good free articles too) I'm not affiliated with that in any way. I just want you to know where to go to find info on the HMA and he gives a full description of it there and shows you the formula.

Well, I guess this is long enough for a first post. Thanks again for a great thread. I look forward to contributing here.

KerisIgnored

Quoting AntraDislikedHi Keris,

I too have been playing around with the vegas tunnel and trying to work out how to trade it in a more mechanical fashion.

I came across the HMA a few weeks ago and found it to be a pretty good little indicator. Seems to have very little lag.

The one I have been using is 'HMA in colour'.

It changes colour as the trend turns...but here is the problem.

I am not 100% sure that once the bar has finished that the colour will remain changed.

Anyone willing to test it?

I first thought of putting this indicator on the weekly chart in place of the 28ema that Vegas mentioned as it seemed ( to me) to be giving more direction.

Anyway this is the HMA in colour on a setting of 21Ignored