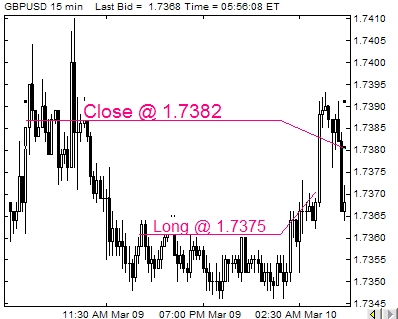

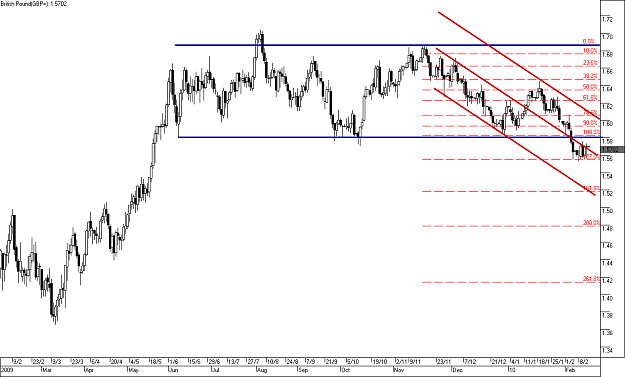

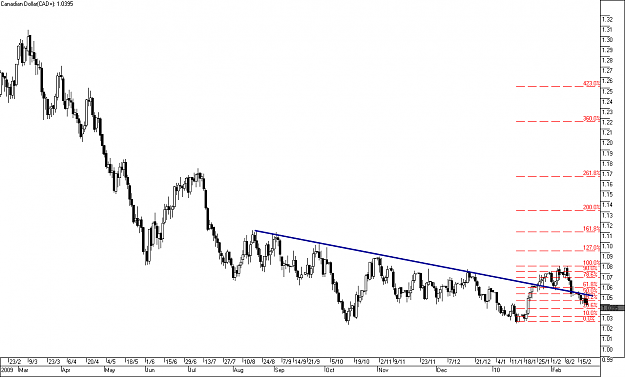

Took a long position @ 1.7588 @ 7.02am London time

Thoughts and Ideas

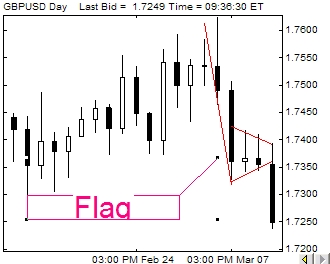

There was still momentum for long according to the day chart and the contracting bollinger bands on the 1 hour chart and the subsequent false break according to bolly rules confirms this. The GMMA was indicating a long trade and one was taken.

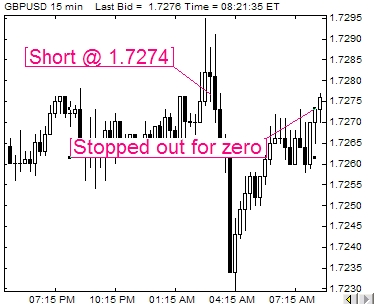

Trade went 20 points in profit and set stop loss to zero as per trading rules.

Conclusion

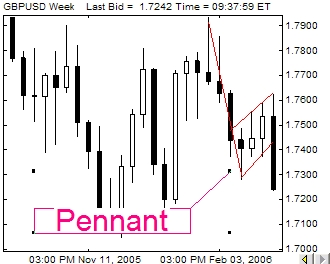

Stopped out for a zero as week chart and the relevant bollinger bands came into play forcing the long position to be short lived. Closed out for a zero point loss.

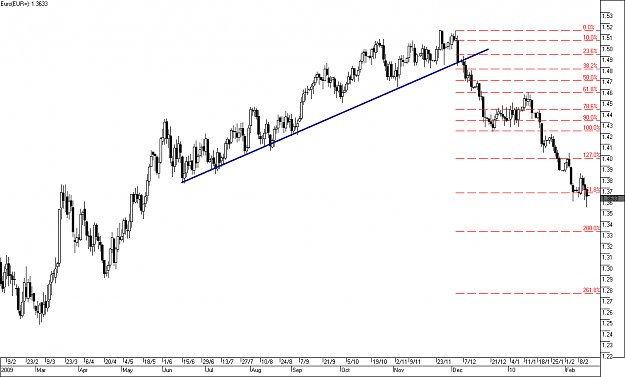

Thoughts and Ideas

There was still momentum for long according to the day chart and the contracting bollinger bands on the 1 hour chart and the subsequent false break according to bolly rules confirms this. The GMMA was indicating a long trade and one was taken.

Trade went 20 points in profit and set stop loss to zero as per trading rules.

Conclusion

Stopped out for a zero as week chart and the relevant bollinger bands came into play forcing the long position to be short lived. Closed out for a zero point loss.

Attached Images