breakout at opening of london ONLY 2009 only

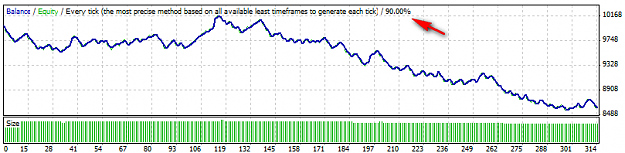

Image 1: Thread starter Method 2% risk per trade 52% profitable trades, 16.4% Max DD and -$1391.56 Total Profit

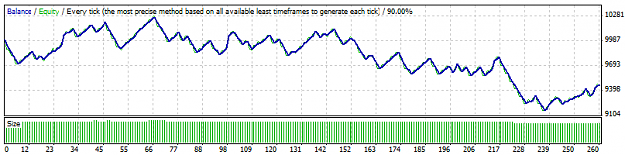

Image 2: Same as above but with 21 Ema filter

57.69% profitable trades Max DD 11.51% and -$541 Profit

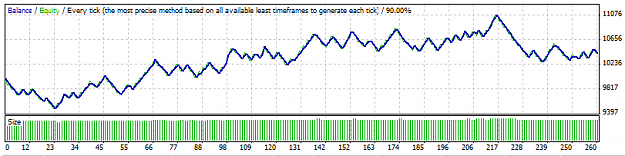

Image 3: risk reward 1:1 sl = 30 tp =30 using filter

8%DD $422 profit

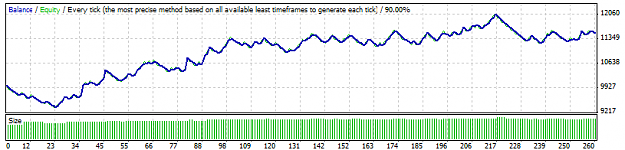

Image 4: tl:30 tp1: 30 tp2:60 using filter

43% profitable DD 7.81% profit $1510.33

Image 1: Thread starter Method 2% risk per trade 52% profitable trades, 16.4% Max DD and -$1391.56 Total Profit

Image 2: Same as above but with 21 Ema filter

57.69% profitable trades Max DD 11.51% and -$541 Profit

Image 3: risk reward 1:1 sl = 30 tp =30 using filter

8%DD $422 profit

Image 4: tl:30 tp1: 30 tp2:60 using filter

43% profitable DD 7.81% profit $1510.33