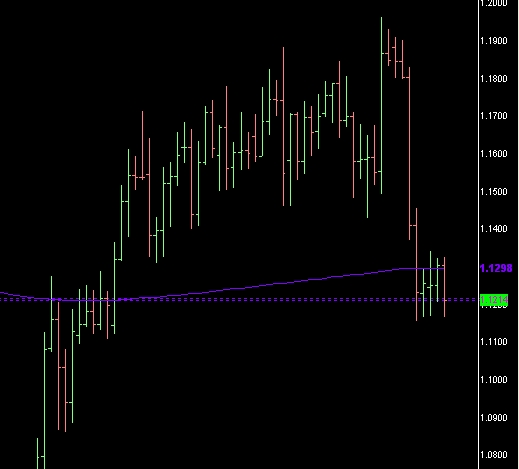

Thin Ice & Eagles Above.

Tread very carefully.

Tread very carefully.

Where can I learn more about Price Action like those in James16 charts? 9 replies

DislikedHello people, my first post in this excellent thread.

I have been reading many pages of this topic and learned about price action patterns and I'm trying to learn about fibo ret from other sources, also about pivot points.

I have some questions about the recommended Time Frame. Jim talks about trading in the Daily and Weekly time frames. I understand this is to reduce noise and to have better quality trades, specially for new trades as myself.

However I see that I need huge stop losses, because in the daily and weekly time frames we have a...Ignored

DislikedHi all - I'm still learning what the different PA bar patterns mean but am I right in thinking that a BEOB at a Swing High is a reversal pattern, whereas a BEOB in a stalled down trend is a continuation pattern?...Ignored

DislikedFor those in the trade.... an update, 54 has been hit as expected and has reversed back to the entry ...lets see what happens from hereIgnored

Dislikedhttp://www.forexfactory.com/showpost...ostcount=24631

on a serious note..... Thanks a lot for this TiaForex.Ignored

DislikedHave to agree. I just read this from a bar in key west. no i havent been trading while i'm here. Too Risky....but having this business alows me to be here..

I think I'll sail home friday.Ignored

Disliked1) Never can it be so. Period Exclamation etc. etc.

2) Don't chase it but allow it to come to you. This takes Time & Focus.

3) Mentally Chasing Pips you left on the table will do one of two things.

a} Drive you Nuts.

b} Give you a further education.

Make sure you know which track you are on.

4) As long as the "Push" is in the basement. Don't Push the Front, that has only one outcome. Push the Understanding.Ignored

Disliked4hr pin on GBPJPY off of PPZ around 141 area. For me the nose is not long enough so I'll probably pass.Ignored