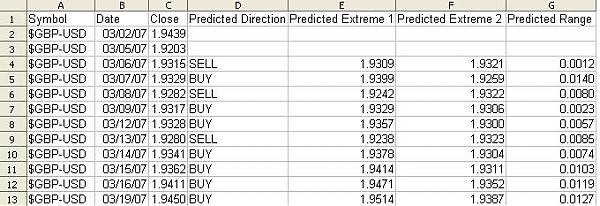

A little spreadsheet I put together using Genesis data. Could it be that simple?

Attached Image

Daily Scalping EA - Discussion Thread 349 replies

genisis data vantagepoint 1 reply

Forward Testing Discussion Thread 241 replies

VantagePoint Sample System 0 replies

VantagePoint Graphics thread 27 replies

DislikedTrinity,

I'm having the same problem w/ CSI for the data of 3/19. For GBP/USD I actually have a high that's lower then the open price. Please let us know your outcome.Ignored

DislikedIMO, this is excellent advice for using VP! Stoney would you have the time to post a chart or two showing how your strategy looks? Thanks in advance.Ignored

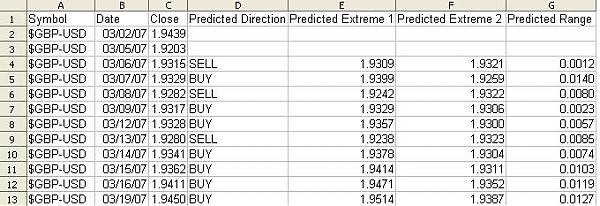

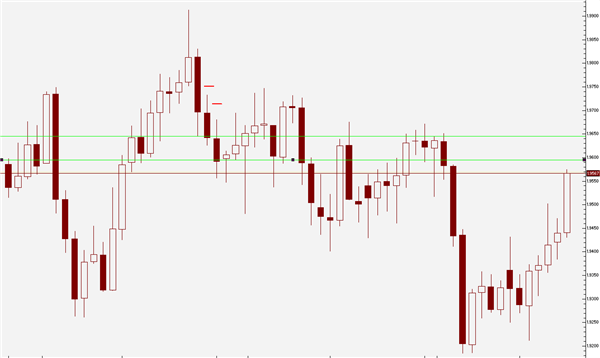

DislikedI'd be happy to. This chart shows the basics. Quality of image not as good as I would like, sorry. I look for a trade as soon as the NI changes.

I hope to have more charts and data for everyone soon. If I make a Camtasia movie, does anyone know how I can make it available to the goup?

StoneyIgnored

DislikedHello All,

I took the liberty of starting a Google group for us which might make it a little easier to share charts and other files which are bigger/more detailed than what is allowed on this forum. The url is:

http://groups.google.com/group/vp-users-group/

Please note that this is a public list, and I have no interest in moderating/censoring what is posted there, who can join, what files are posted, etc. I just want a convenient way to share information with other members of this forum. You are responsible for being respectful and only sharing what you feel comfortable with others seeing. Anyone who accesses the site will be able to see a list of other members including their e-mail address, etc.

Hope this is helpful,

StoneyIgnored

DislikedHowdy all,

Since updating to 7.0 I have been testing different methods. The "4 out of 5" method still works well the key is major $$$ managment. Making sure you let your winners run because if you don't you will at best breakeven. http://www.traderchat.com/boards/ima...lies/frown.gif

I can't stress enough that you need to take any method found here or anywhere else with you brokers candles for the Open, High, Low & Close. That is the data that you will be actually entering and exiting when you trade with REAL $$$$. All brokers data is not the same so your results may not be the same as mine but close.

The method that I have come up with and am trading with REAL $$$ on the GbpJpy & GbpUsd. The results for and again using my brokers candles backtested by hand is:

72% for the GbpJpy with 52% of total trades greater than 100pips

71% for the GbpUsd with 50% of total trades greater than 100pips

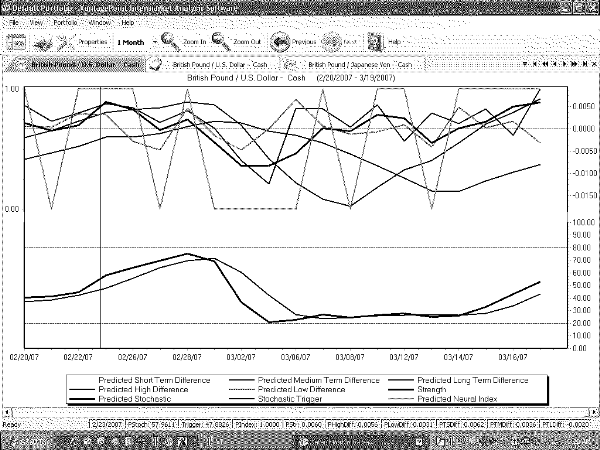

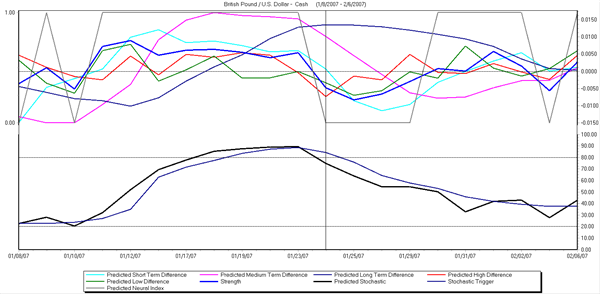

The chart setup and method is :

Predicted Neural Index (NI)

Predicted Short Term Difference (PSTD)

Predicted Medium Term Difference (PMTD)

When the NI changes to a 1 signaling a Long check to make sure the PSTD is above the PMTD. You have a Long signal

When the NI changes to a 0 signaling a Short check to make sure the PSTD is below the PMTD.

I told you it was KISS(Keep it Simple Stupid) http://www.traderchat.com/boards/ima...ies/tongue.gif

Again I found this to work best on the GbpJpy & GbpUsd

Fellow Pip Hunter

BillIgnored

DislikedHi all, i've got a 5/5 on usd yen and swissy long.

Wondering if anyone concurs and has any advice on how to play any of these.

Just trying to get a handle on this method.

My confidence is low just now as I got hammered last week due to some stupid mistakes.

Swissy looks like a mess...the ma system I follow gives me an hourly entry 1.2182 at the moment but a short signal from the 4hr at 1.2218. i also see big resistance zone starting here. Weekly also looks like a short entry is the one to look for. Most of this goes against the 5/5 long. Took the hrly entry....lets see.

Usd yen is falling hard as I type........glad I didnt just jump on that but it has come right down to the predicted low-got to be worth a punt...

It would be nice if this thread became a little more live trade orientated now as there has been so much great info shared and tested perhaps this might kickstart the process

All the best

SSIgnored

DislikedFollowing WilliamK's strategies, look at GBPUSD, EURUSD,GBPJPY for shorts, USDCAD for long. Demo or use tight money management.Ignored

DislikedOf the 4 you quote I only have £$ and Euro $ on vp 6.3 .

I see N.I. down to 0 and predicted short term trend below medium but no 4/5 or better...Is it the new strategy you refer to ? Do you not think the 2 pairs I mentioned above qualify under the 4/5 strategy?

ThanksIgnored