DislikedHi Andrie,

Yes this is definitely a factor for me... but in the long term someof what I have stated in this thread are my long term reasons for dollar weakness but may not play out in the markets in the next few weeks for those specific reasons.

What I do is look at underlying fundamentals to find my reason for being bullish or bearish a currency in the long run (trade deficit, interest rate differentials, etc etc), this enables me to ensure that I am never over exposed on what I believe to be the wrong side of the trade. However it doesn't...Ignored

Hi

Micardo

Can you explain

negative data = risk aversion = dollar strength

positive data = risk appetite = dollar weakness

Risk appetite and Risk Aversion

It would also be great if you can advise of

scenarios of where currency's will be more bullish and where currency will be bearish perhaps using the currency you trade.

Things like politics, interest rates, gdp - basically what main factors drive the fundamentals.

Perhaps stacking the news against a currency

ie

USD

Interst cuts

unemployment high

trade balance

equals - bearish for USD expected downfall

Euro

Unemployment low

houses buying increasing - shows economy boost

Interest put up by 0.5%

equals - bullish for Euro expected uprise

With EU you expect a rally upwards as the economics of the EURO are more bullish than the USD

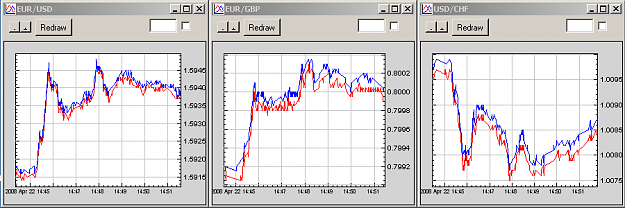

USD/CHF as the USD is bearish and CHF is within the eurozone you would expect a Bearish move

The above just example - would you say this is a good way of interpreting

GAME

Keep up the good work, and thanks for your wealth of infomration