This question is going to surprise a lot of people, but it's something that has had me confused, even though I'm sure the answer is obvious to everyone but me...

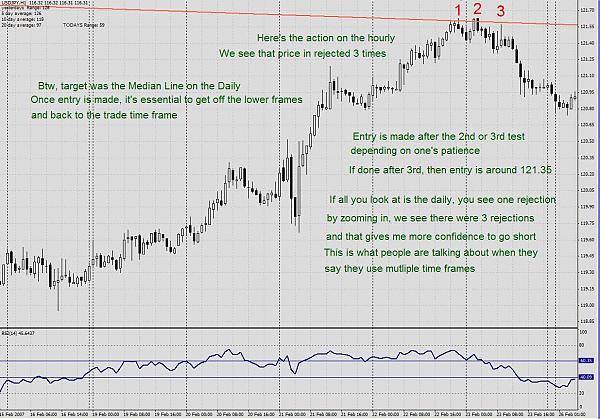

I have trouble understanding the concept of switching to a lower time frame to get a better entry. Could someone please explain?

Many trading strategies suggest doing this. But the current price is going to be the same no matter what time frame you're looking at, so how can switching to a lower one help?

Thanks in advance.

I have trouble understanding the concept of switching to a lower time frame to get a better entry. Could someone please explain?

Many trading strategies suggest doing this. But the current price is going to be the same no matter what time frame you're looking at, so how can switching to a lower one help?

Thanks in advance.