Here is my take on trading - and a recent turn around in my success makes me feel qualified to make some comments. Having tried every new new thing under the sun, and spent my hard earned money on various courses and software products, I can tell you that you donŽt have to spend a penny to learn how to trade - the simple stuff works.

Here are the mistakes I made, and I guess many others make them too:

1. Stops too close.

2. No objective assessment of a target.

3. Overcomplication.

4. Watching indicators instead of price.

5. No recovery strategy for when a trade starts to go wrong.

6. Listening to people and reading books where the author really doesnŽt know what they are talking about.

7. Accepting trading folk law - risk-reward ratios and all that stuff.

8. Expecting the forex markets to be display pattern precision.

My stops are so wide that my risk/reward is often greater than one. Heresy - but it works. The stops are so wide because they give me a chance to recover a losing trade. But youŽll have to figure the rest out for yourself.

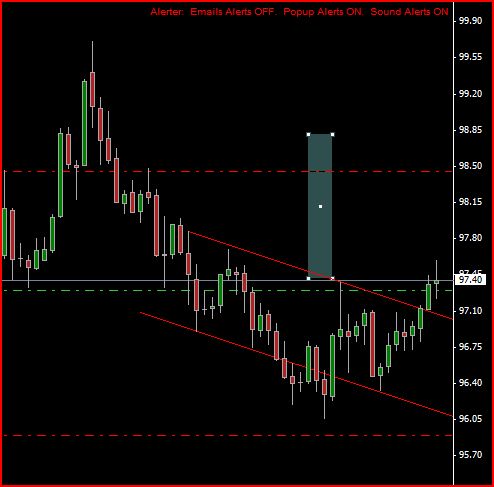

You need some way of determining a target. The old ideas are the best. Head and shoulders - and there are thousands of them in forex - give you a measurement of target - the distance between the top of the head and the neckline. Use it as a provisional target and monitor the trade.

I know some people seem to do well with indicators - but they just didnŽt work for me. Patterns work for me - but IŽve learned not to be too demanding in terms of breakouts and pattern construction. Resist the need to complicate - the simple patterns work if you give them some room.

Look at the overall situation - changes of trend take time to mature (sometimes they donŽt - but thats the exception).

For all those with a math/engineering/science background - which I have too - your background will work against you - at least it did for me. There is nothing precise about trading despite the claims of some Fib people. Dance with the market - donŽt stand so close to your partner that you are treading on their toes all the time - give them some room to move. And if you both want to dance a different dance find a way to exit gracefully.

This is my take - if another paradigm works for you lets hear about it.

IŽll post some trades when IŽve learned how to get a jpeg attached to my posts. I hope this is useful.

Here are the mistakes I made, and I guess many others make them too:

1. Stops too close.

2. No objective assessment of a target.

3. Overcomplication.

4. Watching indicators instead of price.

5. No recovery strategy for when a trade starts to go wrong.

6. Listening to people and reading books where the author really doesnŽt know what they are talking about.

7. Accepting trading folk law - risk-reward ratios and all that stuff.

8. Expecting the forex markets to be display pattern precision.

My stops are so wide that my risk/reward is often greater than one. Heresy - but it works. The stops are so wide because they give me a chance to recover a losing trade. But youŽll have to figure the rest out for yourself.

You need some way of determining a target. The old ideas are the best. Head and shoulders - and there are thousands of them in forex - give you a measurement of target - the distance between the top of the head and the neckline. Use it as a provisional target and monitor the trade.

I know some people seem to do well with indicators - but they just didnŽt work for me. Patterns work for me - but IŽve learned not to be too demanding in terms of breakouts and pattern construction. Resist the need to complicate - the simple patterns work if you give them some room.

Look at the overall situation - changes of trend take time to mature (sometimes they donŽt - but thats the exception).

For all those with a math/engineering/science background - which I have too - your background will work against you - at least it did for me. There is nothing precise about trading despite the claims of some Fib people. Dance with the market - donŽt stand so close to your partner that you are treading on their toes all the time - give them some room to move. And if you both want to dance a different dance find a way to exit gracefully.

This is my take - if another paradigm works for you lets hear about it.

IŽll post some trades when IŽve learned how to get a jpeg attached to my posts. I hope this is useful.

Irregular