DislikedKharvell,

Nice system. I'm going to forward test it.

Taxgeek, I had trouble loading what you posted into MT4, but that might just be me.Ignored

Glad you like the method! Be sure to post your results(only if they are good

QuoteDislikedThanks to Kevin for all the systems and the help along the way.

Does any have a BB indicator for this in MT4?

You may also download from the link below; it has the everything you need, you just have to put all 6 of them on your graph..

QuoteDislikedi did not caught that sorry if my post seems to be harsh that was not my intent...

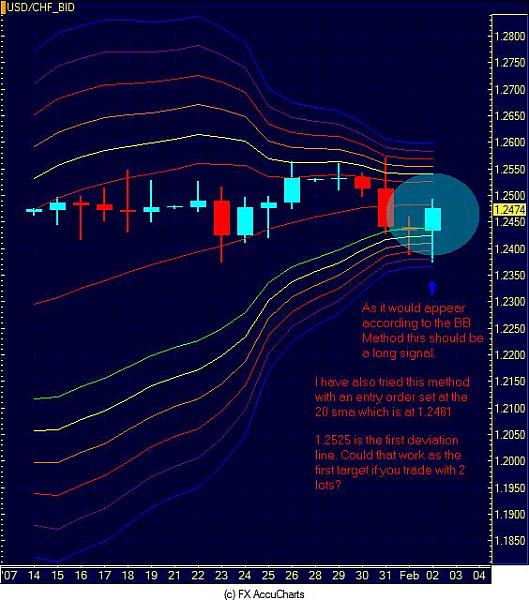

I have tried to back test the BB method but i'm missing the exact explanation for the entry/exit point

In the pdf it's not very clear if you must enter when part of a candle has entered one of the BB and one is fully out, or a whole candle must be in etc...

It seems to be a good method but there is a small lack of explanation (more or less is still OK but to do a proper back test we need a clear explanation in order to make sure that what we do in the back test is in fact what will be done in a forward test )

For example, in a backtest, we are tempted to use what we see and not what we would have see in real time (specificaly candle being completely in the BB )

As they say in Australia, No worries about sounding harsh mate. I'm glad you have found my method somewhat useful. Allow me to clarify:

Enter when the price exits resistance lines and CLOSES in the main channel. Exit when the same thing happens on the other side. The bar can still be touching resistances, it just has to close in the main channel.

Now, we have come up with a couple of variations regarding lots. My favorite set-up that I came up with the help of others is looking at the center line(AKA Simple Moving Average) when an entry signal happens. If the SMA is sloping in your direction, open 2 lots and close one of them AT the SMA. Close the other lot when another entry signal occurs for a new position. If the SMA was not sloping in your direction when the entry signal occurs, enter with one lot, and just TP at the SMA, and call it a day.

I have thought of another signal to enter:

If you have just bought a 1 lot position(because SMA was not sloping in your direction. And the price bounces off of the SMA, you

1)Liquidate your existing lot and

2)Enter a position in the opposite of what you just liquidated.

This new position will be exited as usual with a normal entry signal

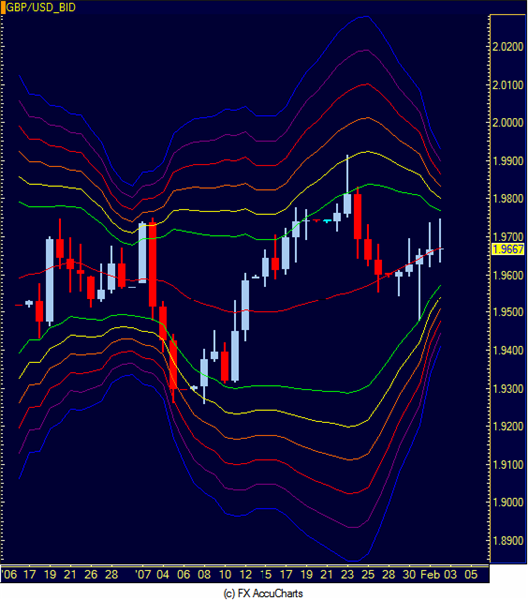

I have posted an example of these "bounce entries" and entering 1 lot vs 2.

It is rather detailed, so please study it closely..

And Yen, I agree with you. Let me know what you think of these "bounce entries".

Attached File(s)