http://bloomberg.com/apps/news?pid=2...&refer=economy

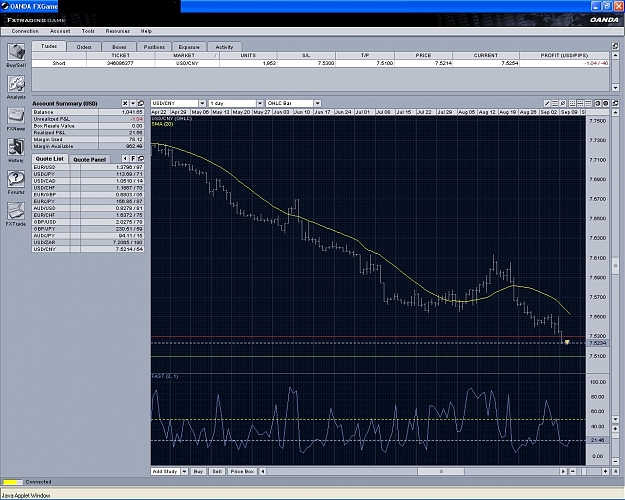

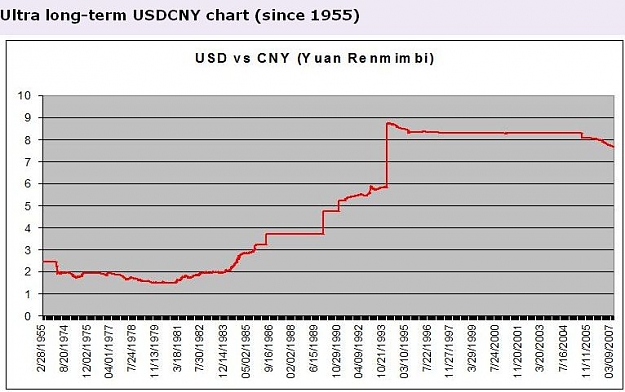

Recently, fed was overseas in China for the Strategic Economic Dialogue where they pushed for higher yuan prices to narrow the trade gap, as they were way undervalued and believed to be manipulated by the chinese for trade advantages.

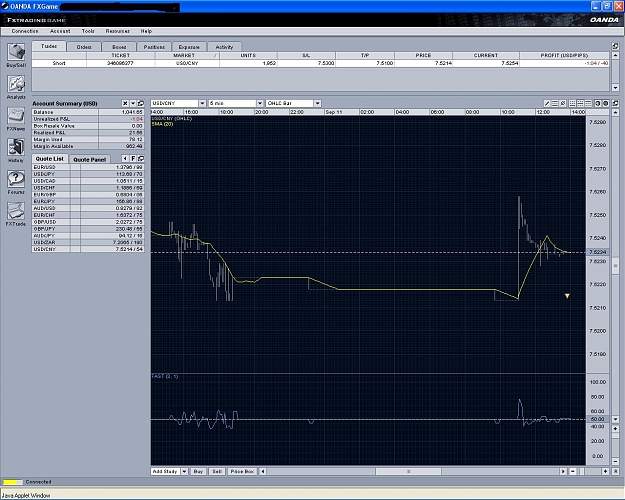

As a result, the chinese are implenting a policy to make purchasing overseas securities easier in order to reduce the value of the yuan. They also stated that "The People's Bank of China wants to slow the yuan's appreciation to prevent local exporters from losing their price advantage. "

Now, isn't the chinese action about decreasing the value of yuan exactly the opposite of what the fed suggested? Maybe the new policy of purchasing overseas securities will help the dollar/euro with more demand but overall, wouldn't the trade gap be wider?