Dear All Traders,

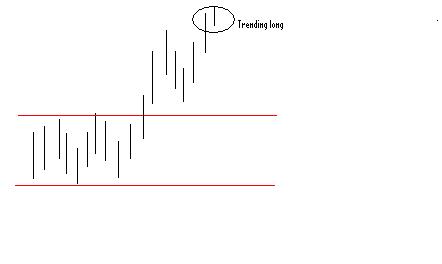

One of the golden rules of trading is "follow the trend".

I would very much like to do it. BUT I find it very hard to find the trend. Does anyone here have any idea of how to find and confirm a trend? I think if one successfully find a trend, it should tell both the direction and duration:

1. Up / Down

2. Within 1 hour / 1 day / 1 week / 1 month

Please share your ideas of how you'd find and confirm a trend and so you can follow it. Thank you!

One of the golden rules of trading is "follow the trend".

I would very much like to do it. BUT I find it very hard to find the trend. Does anyone here have any idea of how to find and confirm a trend? I think if one successfully find a trend, it should tell both the direction and duration:

1. Up / Down

2. Within 1 hour / 1 day / 1 week / 1 month

Please share your ideas of how you'd find and confirm a trend and so you can follow it. Thank you!

make some money, have some fun, leave some footprints