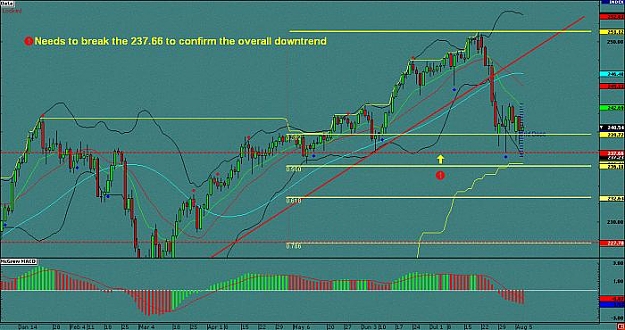

DislikedThere is a descent line running down the peaks.. current level is around 240.85. You can see it, for example, by drawing a line down the recent peaks in 8 hour charts.

In my opinion, it is very unlikely that price will rise above this descent line.Ignored

- Post #4,762

- Quote

- Aug 7, 2007 8:25pm Aug 7, 2007 8:25pm

- | Joined Jul 2007 | Status: Member | 242 Posts

- Post #4,763

- Quote

- Aug 7, 2007 8:50pm Aug 7, 2007 8:50pm

- | Joined Oct 2006 | Status: Member | 1,946 Posts

- Post #4,765

- Quote

- Aug 7, 2007 9:04pm Aug 7, 2007 9:04pm

- Joined Oct 2005 | Status: Member | 3,596 Posts

[

- Post #4,772

- Quote

- Aug 8, 2007 12:19am Aug 8, 2007 12:19am

- Joined Aug 2006 | Status: Member | 3,126 Posts

- Post #4,773

- Quote

- Aug 8, 2007 1:16am Aug 8, 2007 1:16am

- Joined Feb 2007 | Status: Trade @ your own risk | 6,628 Posts

- Post #4,774

- Quote

- Aug 8, 2007 1:25am Aug 8, 2007 1:25am

- Joined Nov 2006 | Status: Dubai | 11,493 Posts | Online Now

Trade what you see, not what you think.

- Post #4,779

- Quote

- Aug 8, 2007 2:32am Aug 8, 2007 2:32am

- Joined Feb 2007 | Status: Trade @ your own risk | 6,628 Posts