Good day all

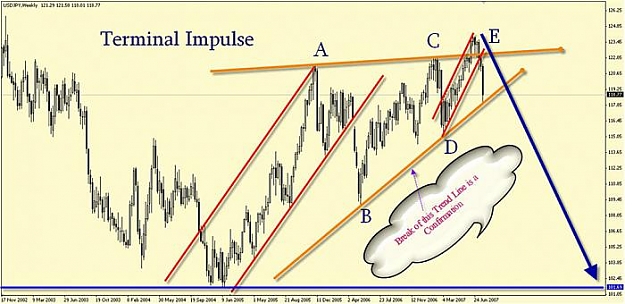

If I am right, it's the end of cary trade

What do you think? Is it possible?

Yen is heading 109 then 101.69 by the end of October 2008

Many thanks

If I am right, it's the end of cary trade

What do you think? Is it possible?

Yen is heading 109 then 101.69 by the end of October 2008

Many thanks