Can anyone teach me Carry Trade and Swing Trades?

From what I understand, Carry Trades are simply holding positions for a very long time for the purpose of "earning" Carry Interest. as an Example, Buy USDJPY, or buy GBPJPY.

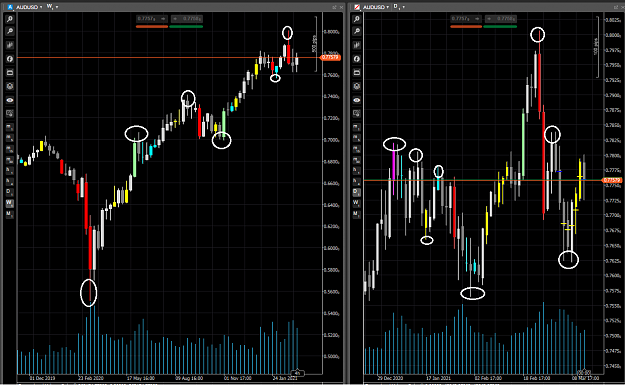

As for Swing Trades, what I understand is that you simply hold the position until it swings in your favor. Like today, GBPUSD went down to 1.8700. While going down, buy and hope it will climb back up again?

From what I understand, Carry Trades are simply holding positions for a very long time for the purpose of "earning" Carry Interest. as an Example, Buy USDJPY, or buy GBPJPY.

As for Swing Trades, what I understand is that you simply hold the position until it swings in your favor. Like today, GBPUSD went down to 1.8700. While going down, buy and hope it will climb back up again?