A trade on EURUSD from yesterday (Wednesday 13th December 2023)

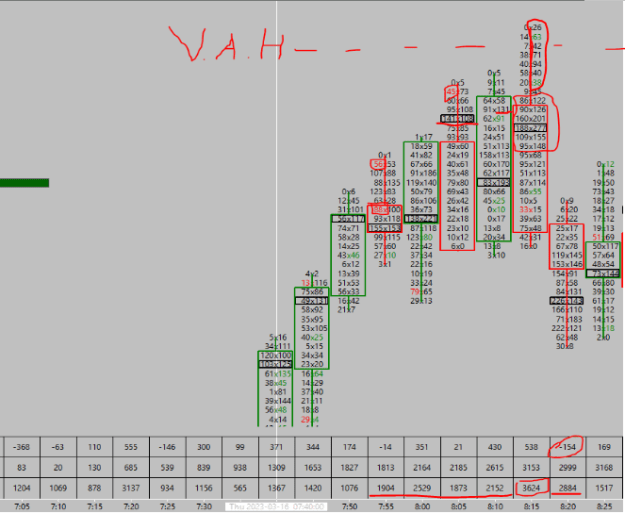

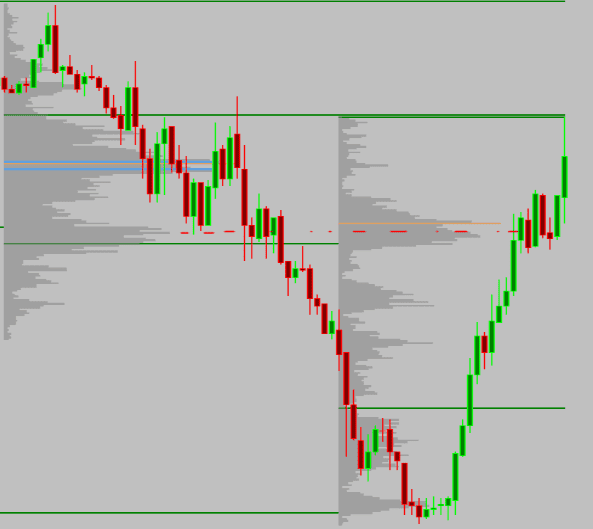

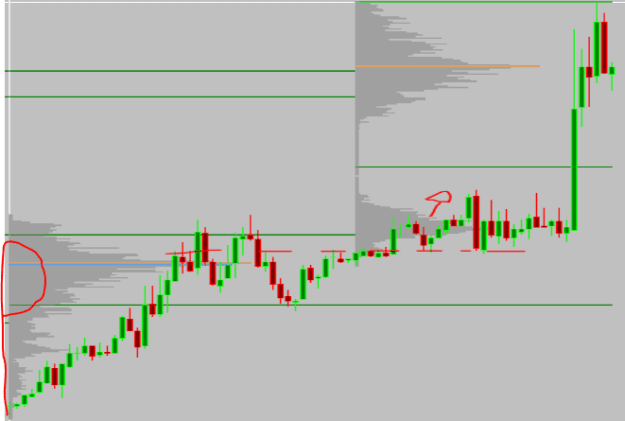

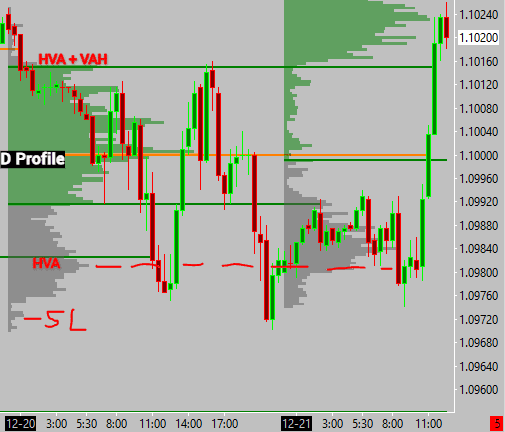

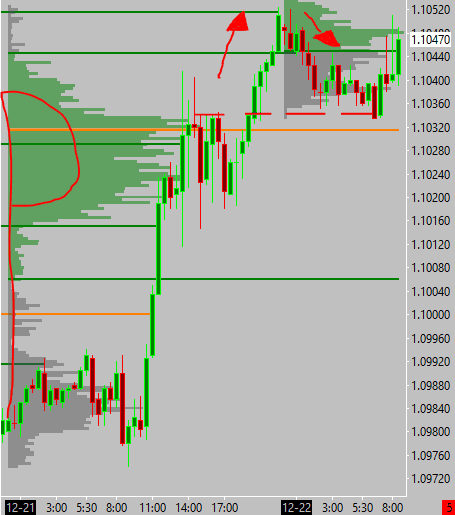

Hello everyone, I didn't have time to get round to posting this trading setup and analysis process yesterday, as have been quite busy. On another note, as I was warned, the idiots have arrived! As the most respected FF members have said, just ignore them and that's what I'll do, I wont go into it any further.On Tuesday, EURUSD created a rough but tradeable 'D' distribution volume profile. There was also other aspects of my trading that led to me being interested in this particular price area, I went over it on the Auction Market Theory thread last night. The trading levels and ranges derived from value areas via market profile coincide with the volume based levels of this strategy! I will not go into it further (maybe ill save it for another topic later on) for the sake of simplicity.

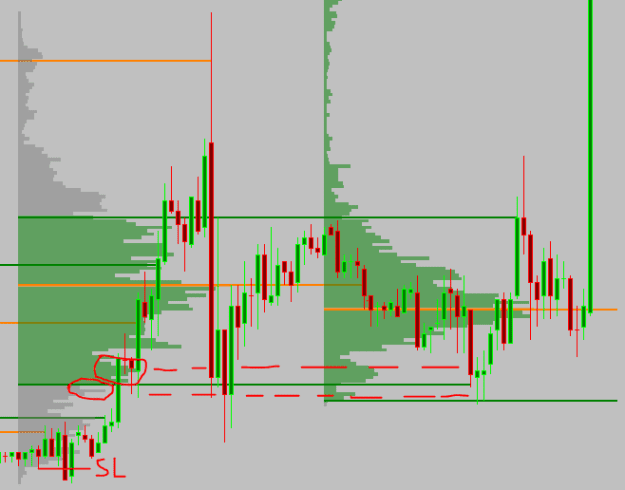

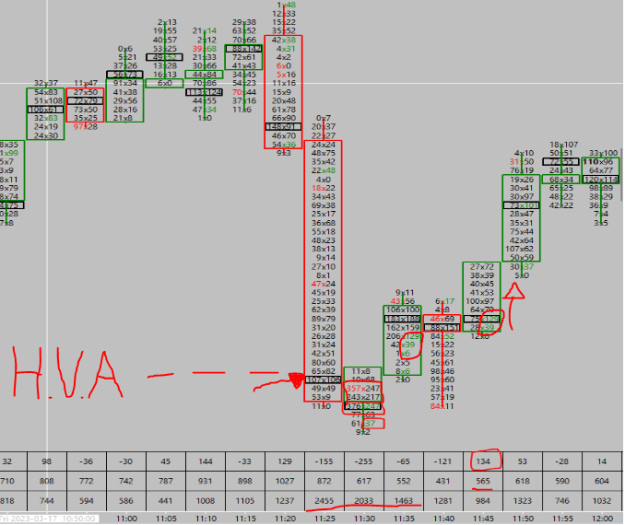

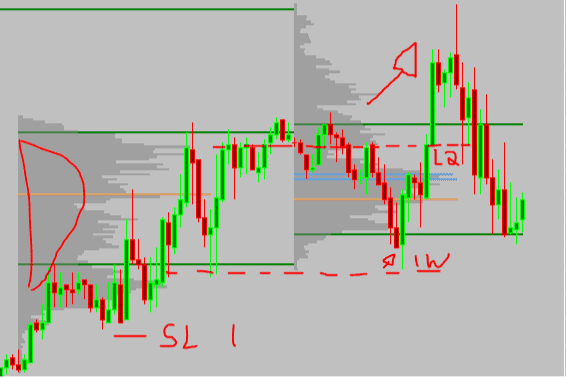

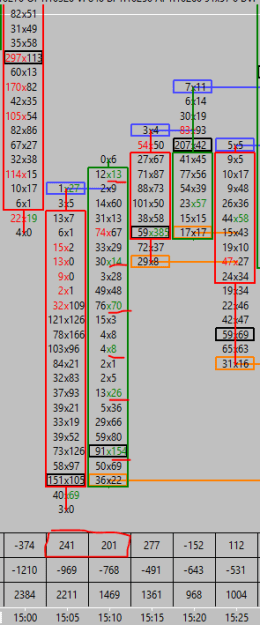

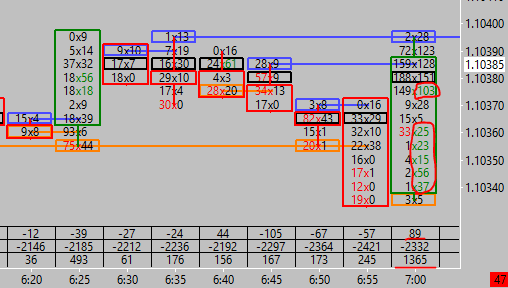

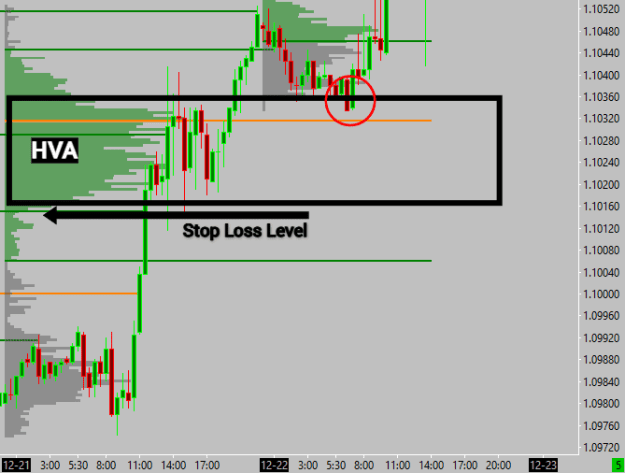

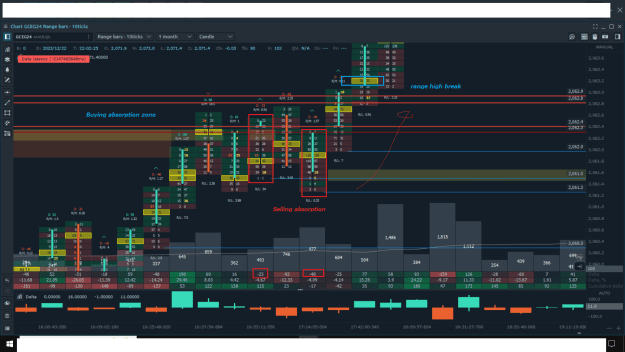

The balanced 'D' distribution volume profile usually tells us the market is in equilibrium (consolidating) and as such, per the rules of this specific profile, I begin by looking for mean reversion style trades. Specifically, by being aware of high volume clusters/areas (HVA) around the top and bottom of the profile, then looking to confirm a potential bounce of said level via the use of order flow. If anyone is confused about the tools, names or rules, I recommend going back to the start of the thread (only 3 pages deep so far!) to see if its been answered and if not, ask away!

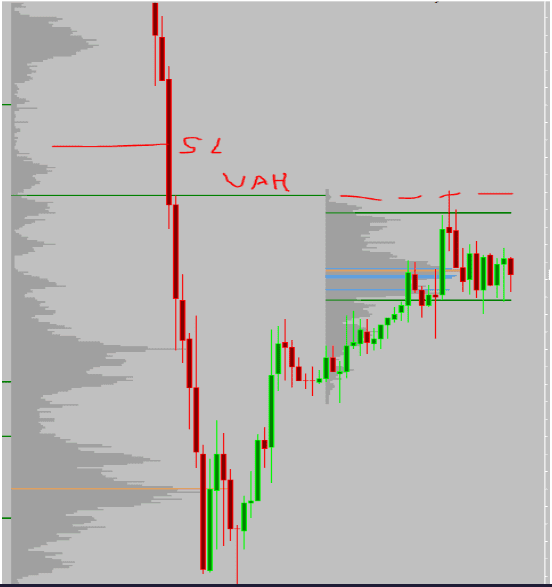

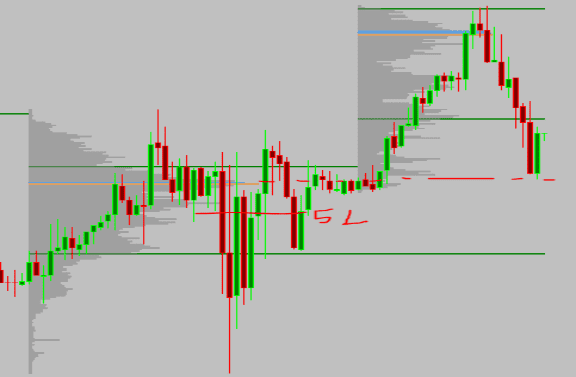

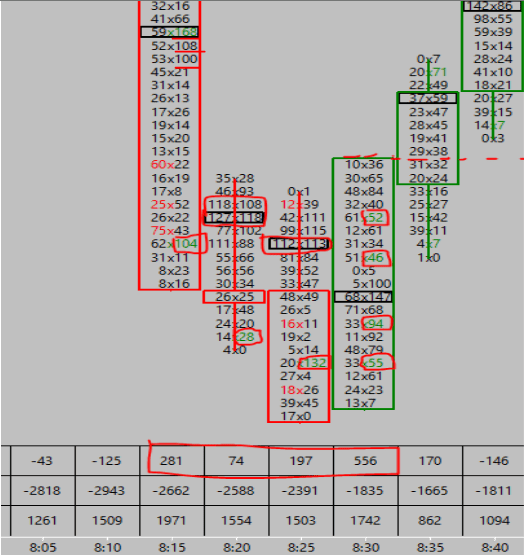

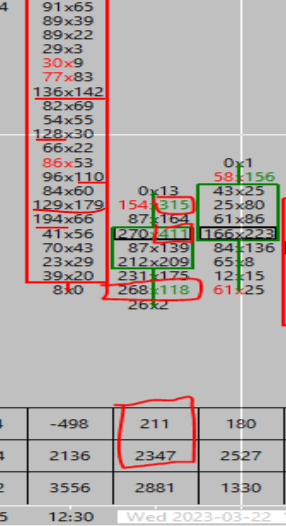

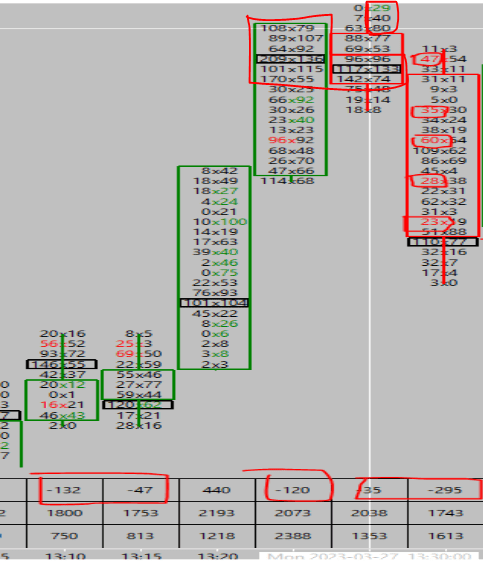

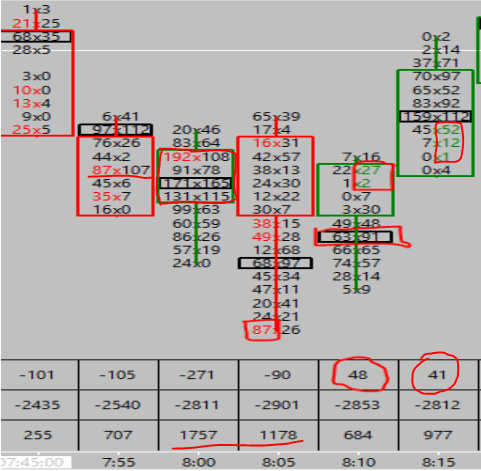

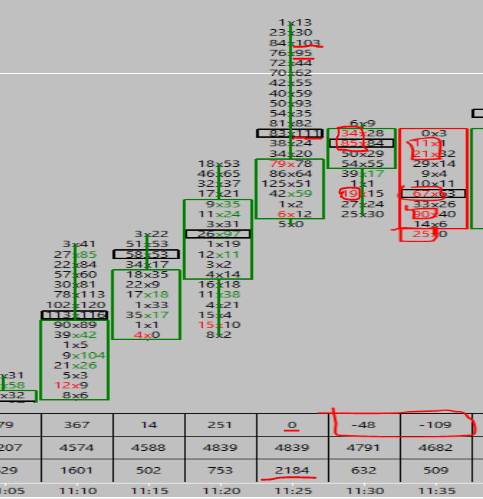

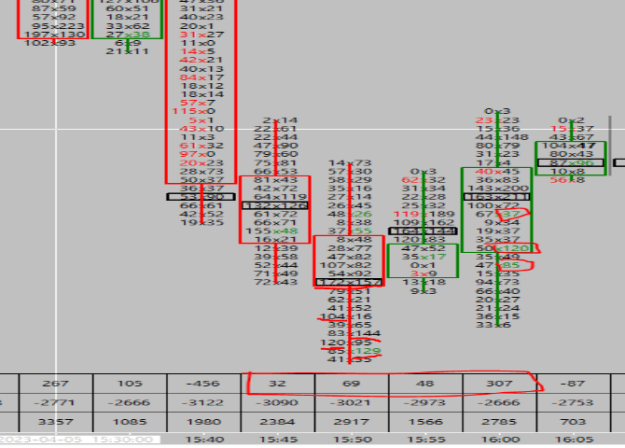

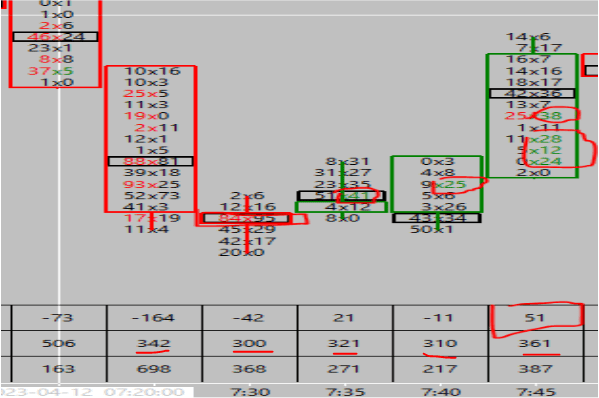

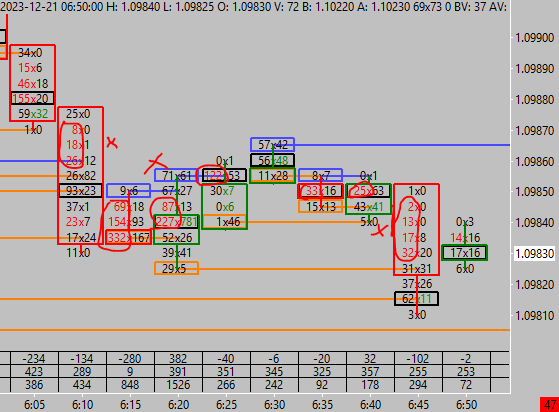

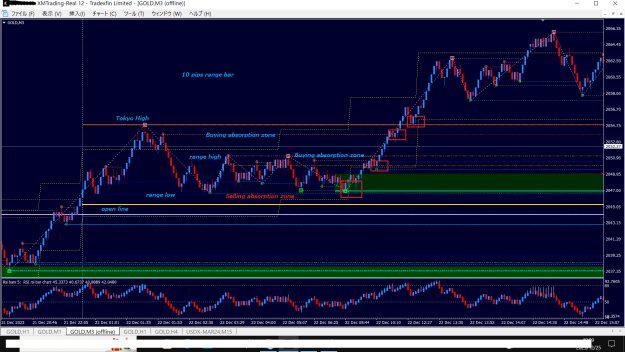

I hesitated trading the first HVA (first dashed line on top) due to the fact by the time confirmations came through, we were almost towards the middle of the profile already. Very quickly after price sold off a few pips more, some of the most bullish confirmations I have seen on order flow for a long time appeared!

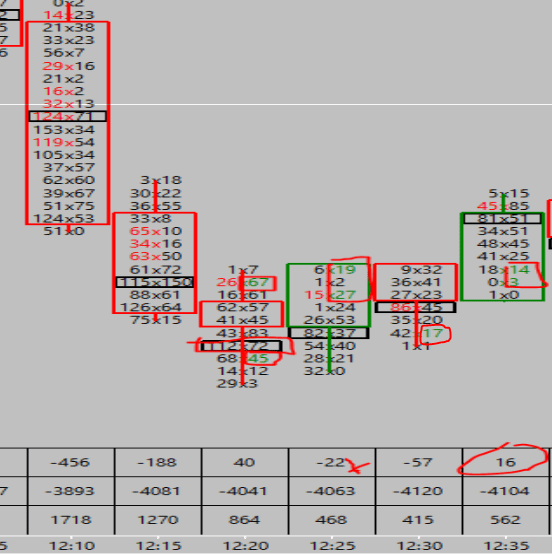

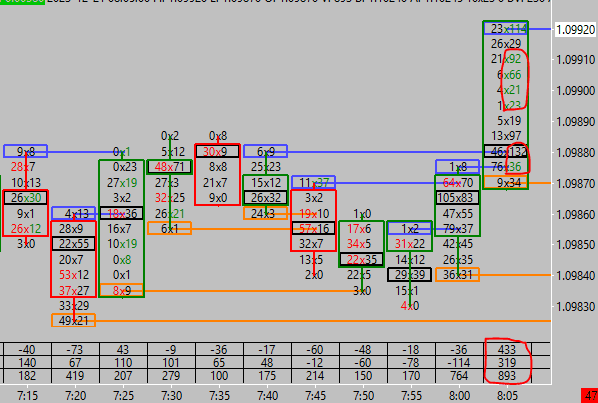

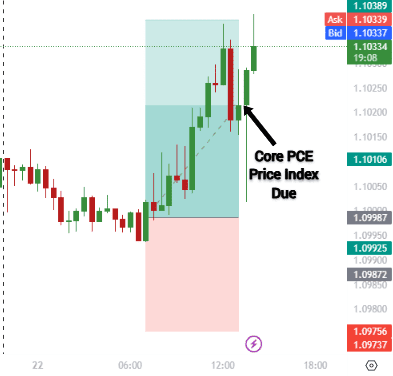

Although the why is not too important, it is interesting! I assume this was (obviously) smart money getting in for the best prices of the day, ahead of the PPI, Fed Funds Rate and FOMC Statement/Commentary which turned their positions massively profitable. This in itself has sparked many ideas for myself about the use of order flow alone, heading into significant economic news/data releases, maybe it will for you too!

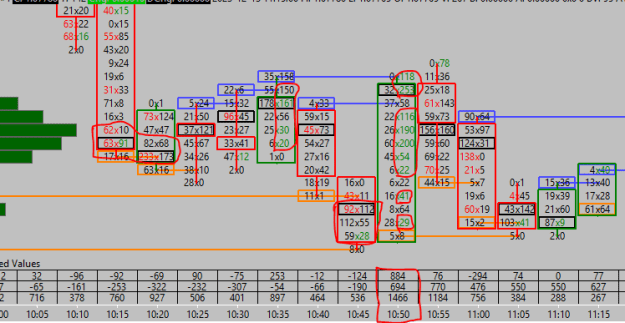

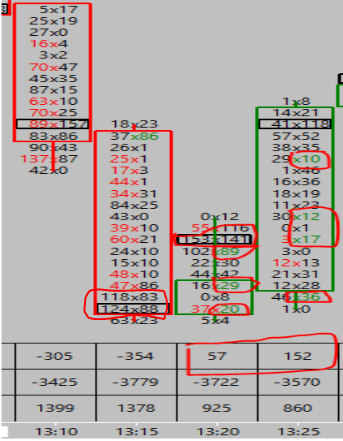

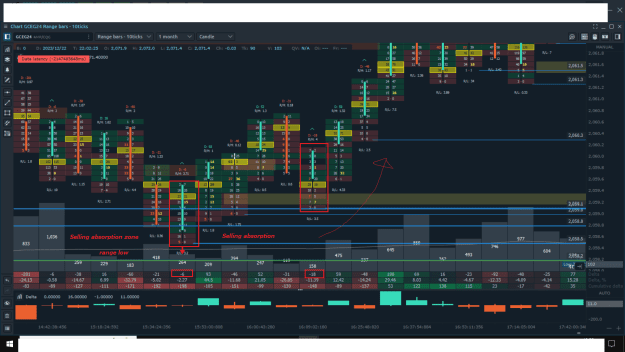

So lets discuss order flow confirmations, as price came down, the first textbook confirmation came through. That being large volumes on the bid, likely passive participants entering where the HVA is, stopping price from going further. Next each bullish candle was an engulfing candle, that had many imbalances within, signifying pure buyer aggression! The entry trigger however came after the 10:50AM bullish candle with many stacked imbalances and a very strong delta as well as cumulative delta turning positive on the day.

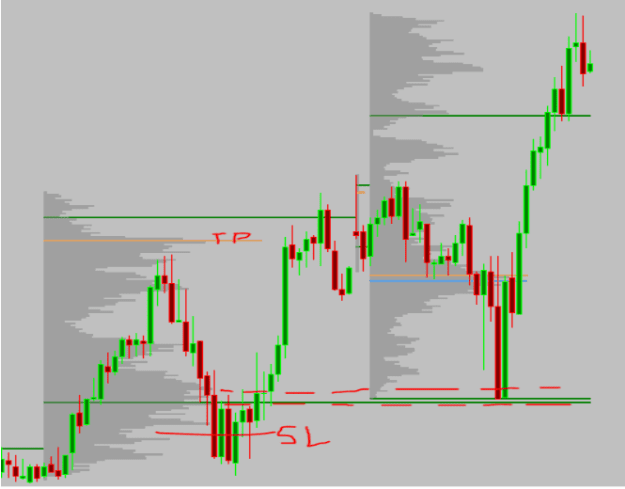

This was directly on the high volume cluster(s) we were interested in, in a market we suspect is in equilibrium (mean reversion price action is expected), with the added propensity to the trade from the order flow confirmations we now have a very strong trade setup. Lets talk about the plan.

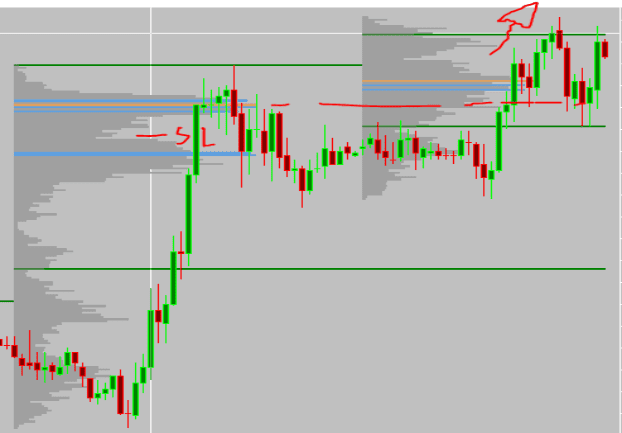

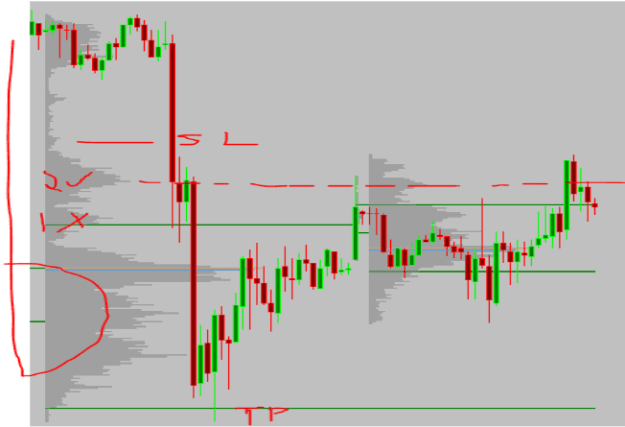

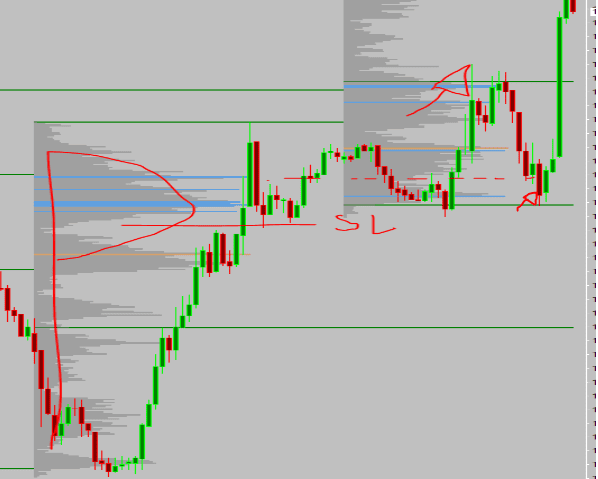

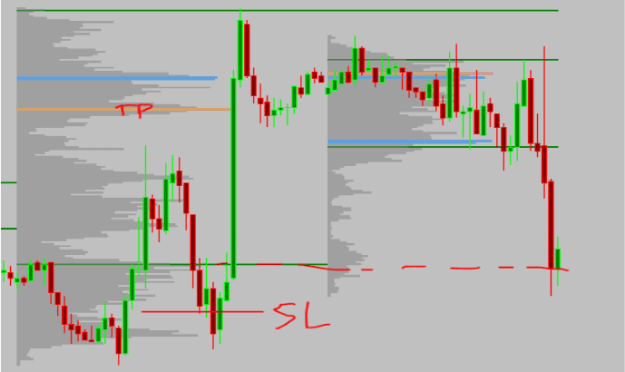

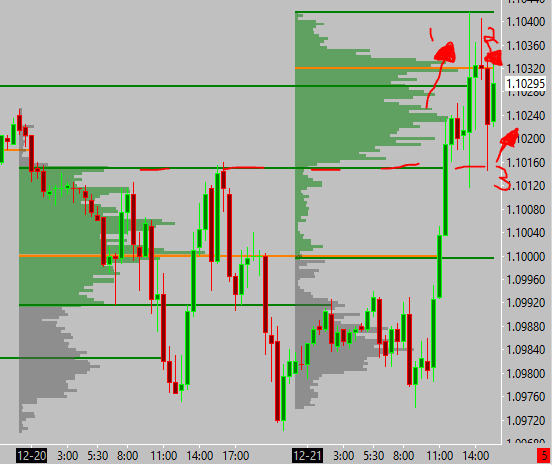

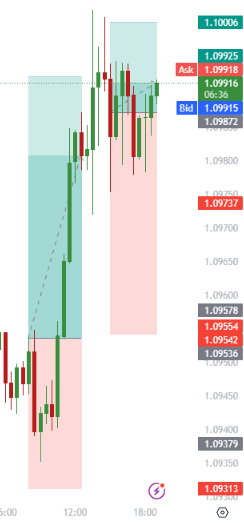

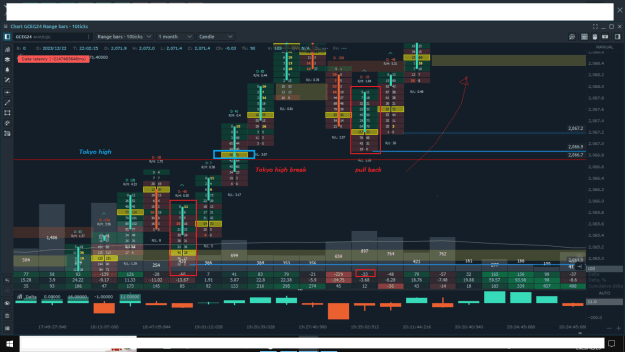

The stop loss is to be placed under a high volume area, ideally behind the HVA price reacted to however, this is not always possible. The take profit, as per the rules of this profile, goes at the previous day's P.O.C. However, a minimum of a 1:1.75 risk-reward ratio is required, so it was stretched to meet criteria.

Exit the trade just before any significant economic news/data releases, to eliminate that tail risk.

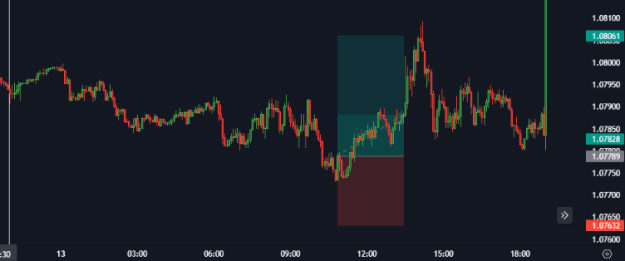

Here's a plain chart showing the correct stop loss and profit target position and where the trade was entered and exited, just ahead of US PPI and Core PPI for a small gain of 0.5%.

Seeking Fair Value

3