Take note: I haven't backtested this thoroughly so I don't have stats for this. I'm just hoping to join in the ride here. I will utilise a very old but basic entry method from a guy called Hector Deville from his 3SMA course. I will incorporate some ICT techniques as an alternative method of technical analysis. However, I will try to keep it simple.

Trading Plan

Trading Plan

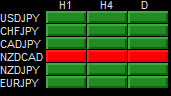

- Watchlist

- Scan forex pairs, metals, commodities, energy CFDs over weekend

- Choose those which look good and build a watchlist for the coming week

- Use push alerts to get notified of potential opportunities and also to step away from charts

- Timeframes

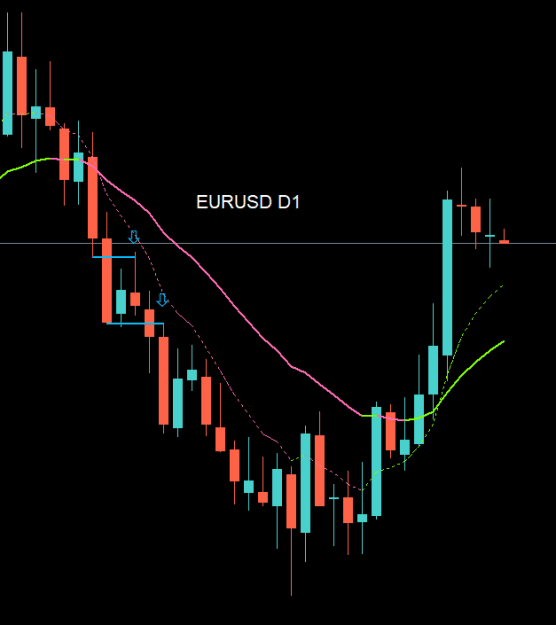

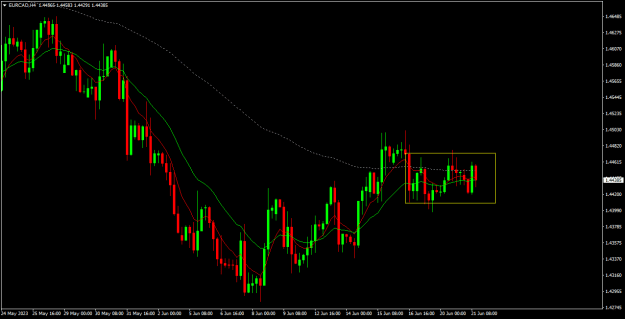

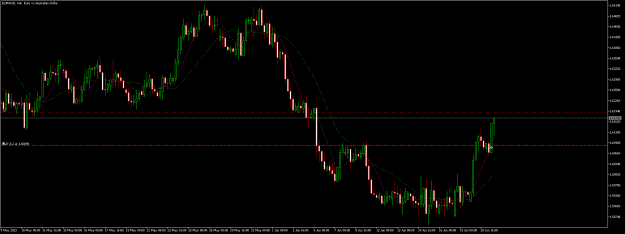

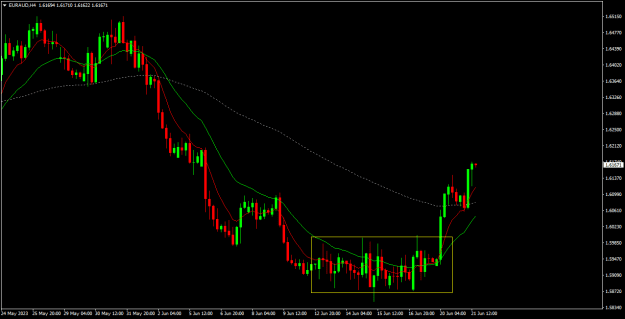

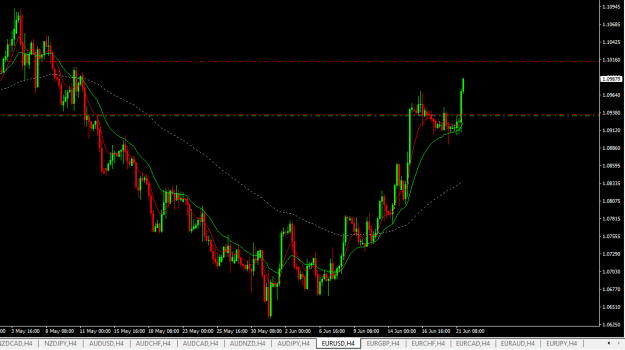

- W1/D1 for overall trend and macrostructure

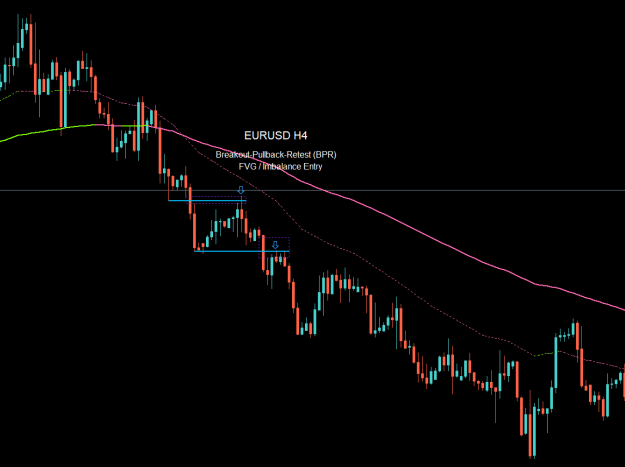

- H4 for mini/inner trend and microstructure

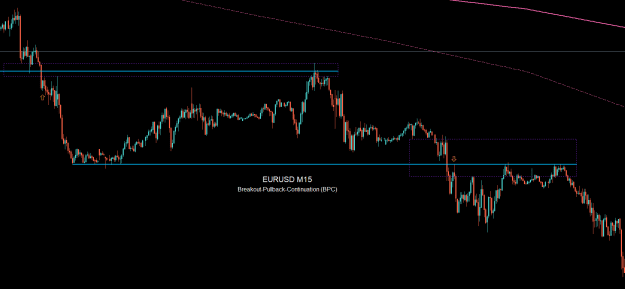

- H4/H1/M15/M5 for entry

- Trend Condition

- 8-21 EMAs crossover

- Sloping and parallel EMAs

- Entry Model

- Horizontal/Trendline Breakout (Hector Deville Method)

- Breakout-Pullback-Continuation (BPC)

- Breakout-Pullback-Retest (BPR)

- Micro Market Structure Shift (MSS)

- Fair Value Gap (FVG) entry

- Horizontal/Trendline Breakout (Hector Deville Method)

- Confluence

- Fibonacci Levels

- Fibonacci Extensions (Targets)

- Support Resistance

- Imbalances / FVG

- Important Levels (Possible Trend Reversal)

- Monthly High/Lows

- Weekly High Lows

- Significant S/R

- Stop-Loss

- Behind candle

- Behind FVG

- Behind Swing

- Take-Profit

- 138.2% extension

- 161.8% extension

- Monthly High/Lows

- Weekly High/Lows

- Trailing SL behind EMAs (current or lower TF)

- Correlation

- Do not open positions on correlated charts

Ok, I think i've detailed my trading plan out enough. I will post screenshots and images of the entry methods in further posts.

Leave the Gun, Take the Armani