Hey OT, I couldn't agree more with what you wrote.

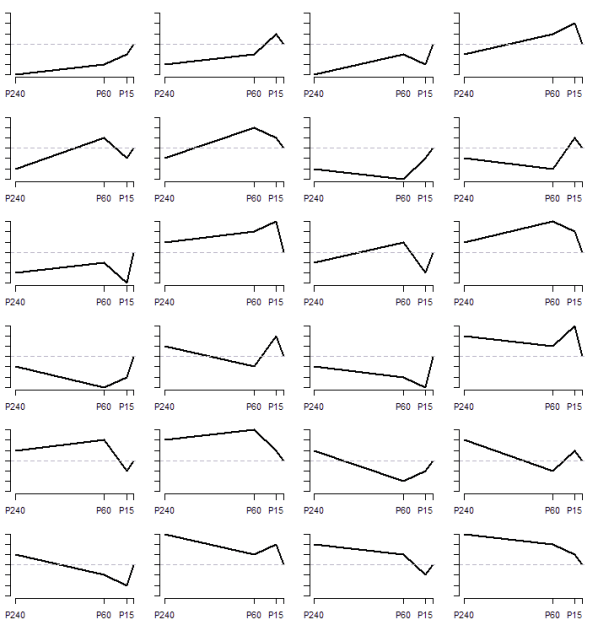

I won't argue with you. All I'm looking for is a simplication. Wouldn't you have drawn the same conclusions just with these 4 reference lines? Why do you think looking at more data is better? Yes, I can see that only using 4 points would sometimes lead to the wrong conclusion. But in the same way one could argue that looking at too many data would make you aware of conflicting data which may distort your pov. Just my thoughts on the matter.

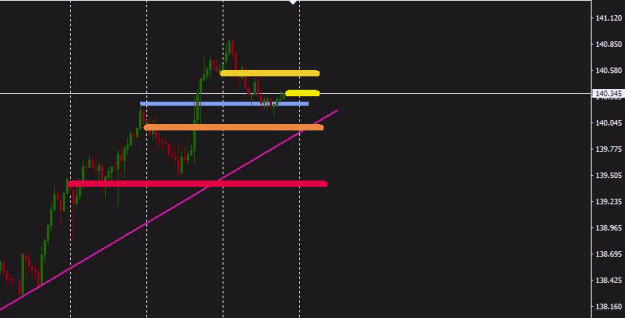

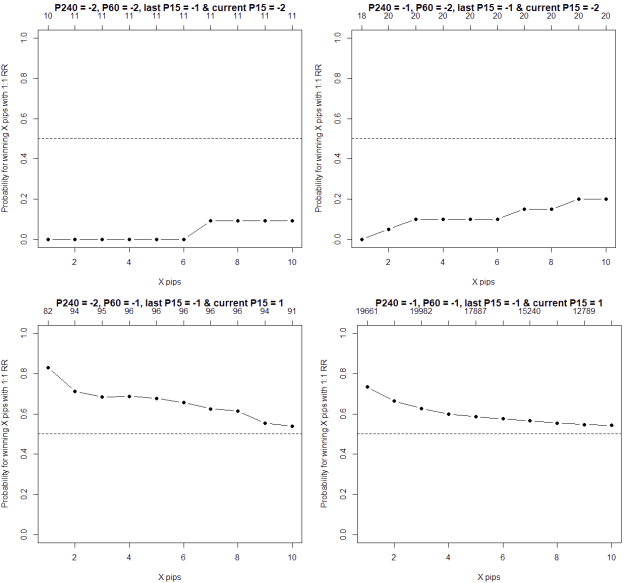

Reference lines on trends:

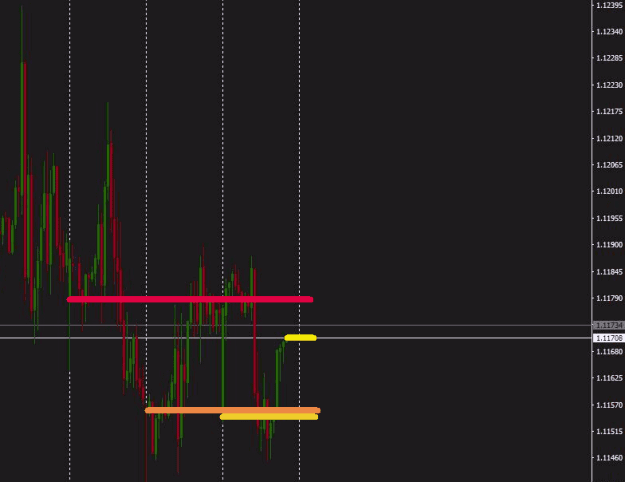

Reference lines in ranges:

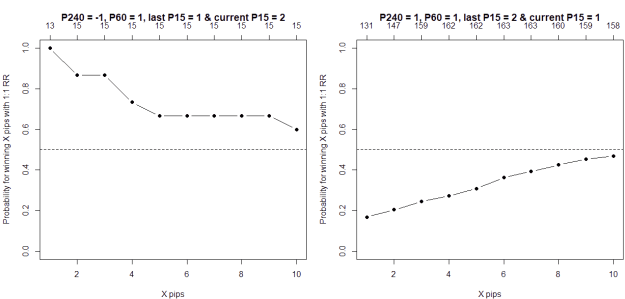

Could you somehow agree with my arguments? Why shouldn't we then be able to find an agreement on when we would trade or when we wouldn't trade. How far needs the current price to be distant to the other 3 reference points to enter? What has to happen else to enter? Which orders of reference lines would we accept to take a trade? Should the three distances (current price vs. open at current day, open last day, open two days ago) differ for different reference line orders? How?

I would accept if you say that you don't see why not to trade this way. But then I'd kindly like to ask what is missing?

DislikedAs soon as I read about using a "reference point", I immediately thought "oh boy, someone is going to mention CrucialPoint"... Well, it didn't take long. IMO, you're on the wrong path if you're trying to find some magic bullet with a reference point idea. Especially if that reference point is out of context, i.e. a rolling 1s, 1M, 5M, 15M... reference point. There is no point in doing statistical studies with such a general approach, there is zero edge here (Adam Grimes has done some work to that extent). I know you never mentioned trying to find...Ignored

Reference lines on trends:

Reference lines in ranges:

Could you somehow agree with my arguments? Why shouldn't we then be able to find an agreement on when we would trade or when we wouldn't trade. How far needs the current price to be distant to the other 3 reference points to enter? What has to happen else to enter? Which orders of reference lines would we accept to take a trade? Should the three distances (current price vs. open at current day, open last day, open two days ago) differ for different reference line orders? How?

I would accept if you say that you don't see why not to trade this way. But then I'd kindly like to ask what is missing?