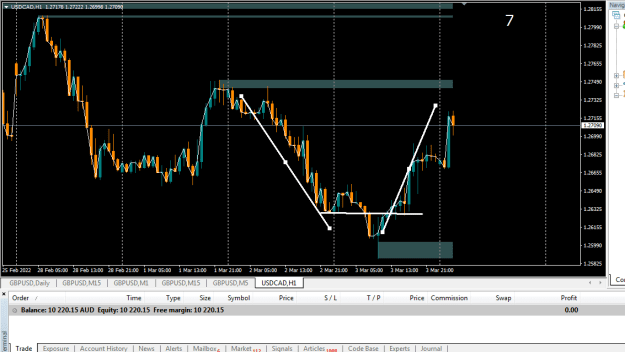

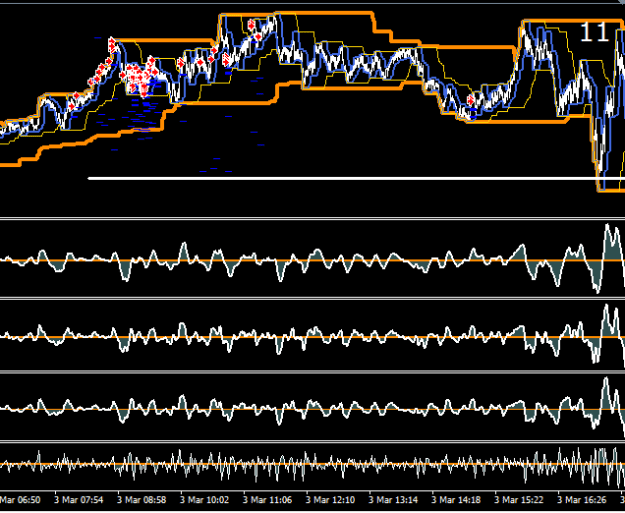

I see that this system would need some kind of safety net in case something goes wrong.

if the DD cannot be kept under control, it is a problem.

keep up the good work.

if the DD cannot be kept under control, it is a problem.

keep up the good work.

1