Twin RSI

This is a mechanical yet simple trading strategy. Just follow the steps that I am going to explain below, and you will find your trading job very much easier and stress free.

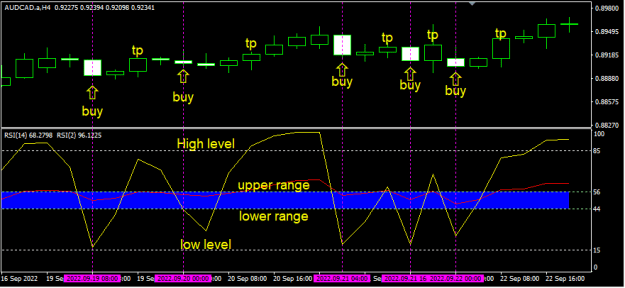

First, the chart setup (a template has been attached for your convenience). Fast rsi (yellow) period =2, high level = 70 and low level = 30. Slow rsi (red) period = 14, upper range =56, lower range = 44. Both rsiís are set in the same window.

There are 3 trading strategies that one can apply using the same chart setup. I will explain one of them that will generate more trades. The underlying principles behind the strategy are:

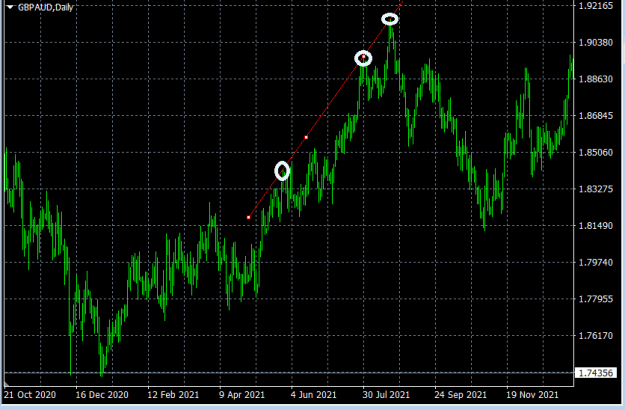

1) Market is moving in sideway directions.

2) Any spike up or down will not last for long. There is a high chance that the market will reverse in the opposite direction after a spike.

3) Open an order against the spike direction to profit from its eventual reversal.

4) Choosing currencies that is highly correlated (https://www.myfxbook.com/forex-market/correlation) which tend to be more stable.

5) Make sure there is no imminent high impact news on the pair that you are going to trade.

6) Avoid high volatility, we are looking for a quiet and stable movements for the targeted pair.

7) I prefer to trade on H4 timeframes. Cost of market spreads will form a higher proportion to the net profit or loss for trading the lower timeframes.

Open buy market orders.

1) Slow rsi must stay in between the upper and lower range.

2) At the close of a down bar (open > close), preferably with bigger candle body.

3) Fast rsi penetrated from above, crossing the upper and lower range together.

4) Fast rsi must close above the low level.

5) Open a buy market order at the close of the bar.

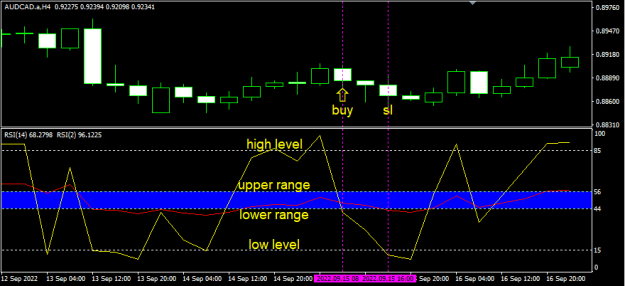

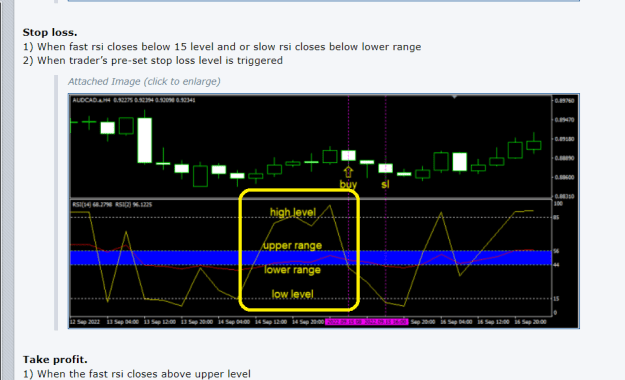

Stop loss.

1) When fast rsi closes below 15 level and or slow rsi closes below lower range

2) When traderís pre-set stop loss level is triggered

Take profit.

1) When the fast rsi closes above upper level

2) When traderís pre-set take profit level is triggered

Notes:

Use the reverse steps to trade for sell orders.

There are ways to improve the yields of the strategy depending on the traderís risk profile.

1) Use trend indicators like ADX, Momentum, etc to further confirm the sideway markets.

2) Use currency strength meter to select two currencies that have similar strengths.

3) Alter the rsi parameters to increase/reduce the risks.

Good luck!

Attachment g

This is a mechanical yet simple trading strategy. Just follow the steps that I am going to explain below, and you will find your trading job very much easier and stress free.

First, the chart setup (a template has been attached for your convenience). Fast rsi (yellow) period =2, high level = 70 and low level = 30. Slow rsi (red) period = 14, upper range =56, lower range = 44. Both rsiís are set in the same window.

There are 3 trading strategies that one can apply using the same chart setup. I will explain one of them that will generate more trades. The underlying principles behind the strategy are:

1) Market is moving in sideway directions.

2) Any spike up or down will not last for long. There is a high chance that the market will reverse in the opposite direction after a spike.

3) Open an order against the spike direction to profit from its eventual reversal.

4) Choosing currencies that is highly correlated (https://www.myfxbook.com/forex-market/correlation) which tend to be more stable.

5) Make sure there is no imminent high impact news on the pair that you are going to trade.

6) Avoid high volatility, we are looking for a quiet and stable movements for the targeted pair.

7) I prefer to trade on H4 timeframes. Cost of market spreads will form a higher proportion to the net profit or loss for trading the lower timeframes.

Open buy market orders.

1) Slow rsi must stay in between the upper and lower range.

2) At the close of a down bar (open > close), preferably with bigger candle body.

3) Fast rsi penetrated from above, crossing the upper and lower range together.

4) Fast rsi must close above the low level.

5) Open a buy market order at the close of the bar.

Stop loss.

1) When fast rsi closes below 15 level and or slow rsi closes below lower range

2) When traderís pre-set stop loss level is triggered

Take profit.

1) When the fast rsi closes above upper level

2) When traderís pre-set take profit level is triggered

Notes:

Use the reverse steps to trade for sell orders.

There are ways to improve the yields of the strategy depending on the traderís risk profile.

1) Use trend indicators like ADX, Momentum, etc to further confirm the sideway markets.

2) Use currency strength meter to select two currencies that have similar strengths.

3) Alter the rsi parameters to increase/reduce the risks.

Good luck!

Attachment g

Attached File(s)