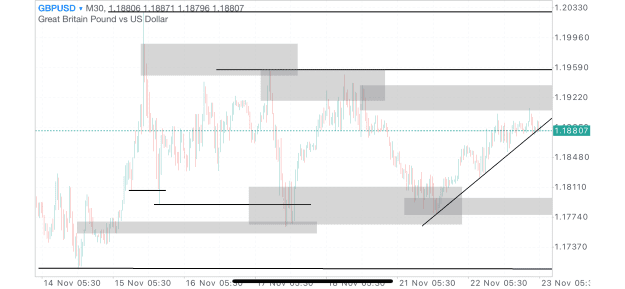

DislikedIf price made a CHOCH on 1.17067 price, it is more likely (in my opinion) to resume its downtrend.Ignored

Just my view, could be wrong.

Today PMI and 4hr candle are bearish, can see some volatility

Not afraid to be wrong, ik what am goin' to lose!

1