DislikedI have to trade at 6 uk time for an hour, I trade the 1 min and 5 min chart.Ignored

Thats pretty tough, you have a lot of things going against you. First that time of day is going to be slow because traders are waiting to see what FO and LO will do. Because its slow your commission is going to eat a huge chunk of your profits as well as compound your losses.

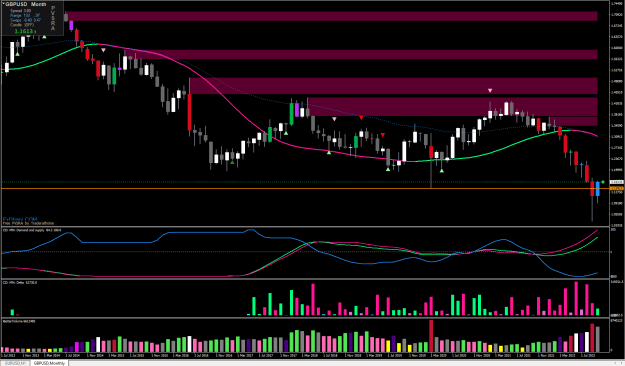

Forex is a slow market, it tends to grind sideways for hours and hours before making a move, Friday I shorted EJ a couple of hours into Asia and it took 5 hours before the pair started moving south. Maybe spot gold/oil would be better? They tend to be faster markets. Either way do your back testing to get an idea of what you can expect.

Also only trading an hour doesn't give you a lot of time to do your background analysis on top of finding a trade. If I were in your situation I'd go up to a H4/H8/H12/D1 time frame. I don't do much for the first 2-3 bars after I get into a trade, if I was trading a H4 chart that would give me 8-12 hours before I'd have to look at my charts again.