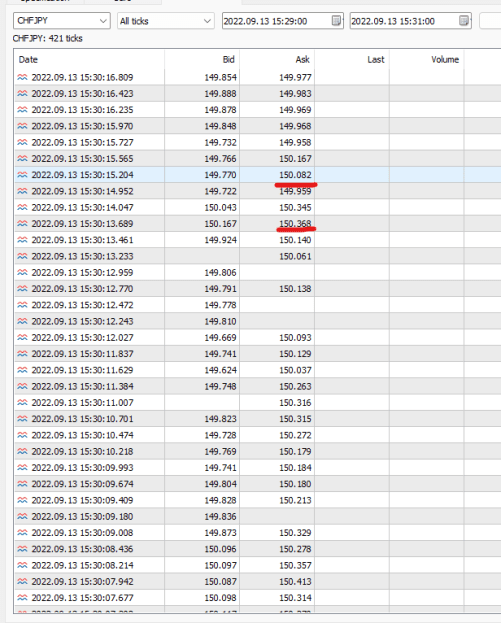

Disliked{quote} Really ? MFF has a trailing DD for the day ? Where did you read this ? It is still from the start of the new day and not trailing as I read on their website. You can see this. {image}Ignored

I can't see it on their site...

which is not the easiest to navigate, I gotta say.

1