Half of the time, the market is building resistance and support levels, and

- Post #153,742

- Quote

- Aug 5, 2022 5:17pm Aug 5, 2022 5:17pm

- Joined Oct 2018 | Status: Discipline creates Lifestyle | 2,125 Posts

Risk comes from not knowing what to do

- Post #153,743

- Quote

- Aug 5, 2022 5:17pm Aug 5, 2022 5:17pm

- Joined Jul 2012 | Status: CME seat owner | 6,134 Posts

Be hopeful in a winning position, and fearful in a losing position.

- Post #153,744

- Quote

- Aug 5, 2022 5:57pm Aug 5, 2022 5:57pm

- Joined Sep 2018 | Status: Trader Man | 1,575 Posts

"No pain no gain"

- Post #153,745

- Quote

- Aug 6, 2022 3:03am Aug 6, 2022 3:03am

- Joined Mar 2008 | Status: Name real with real own way | 20,453 Posts

Not understand?better not follow my analyses!doubt clearer first, risks ++

- Post #153,746

- Quote

- Aug 6, 2022 4:46am Aug 6, 2022 4:46am

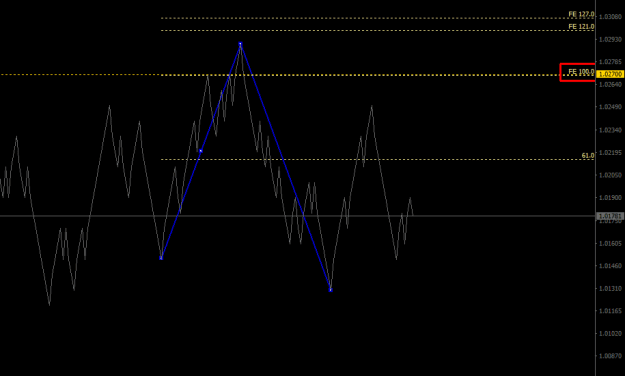

- Joined Jun 2016 | Status: Sharing EUR/USD Ideas and Insights | 9,040 Posts

Looking for profitable short term trades ...|

- Post #153,748

- Quote

- Aug 6, 2022 10:42am Aug 6, 2022 10:42am

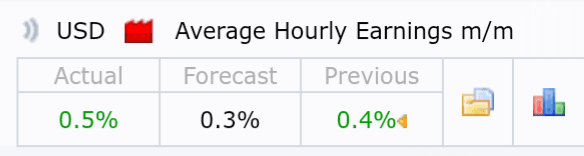

- Joined Mar 2006 | Status: Trade the reaction not the news! | 10,239 Posts

- Post #153,749

- Quote

- Aug 6, 2022 1:58pm Aug 6, 2022 1:58pm

- Joined Sep 2017 | Status: Member | 4,285 Posts

- Post #153,750

- Quote

- Aug 7, 2022 12:37am Aug 7, 2022 12:37am

- | Joined Feb 2022 | Status: Member | 140 Posts

- Post #153,752

- Quote

- Aug 7, 2022 3:29am Aug 7, 2022 3:29am

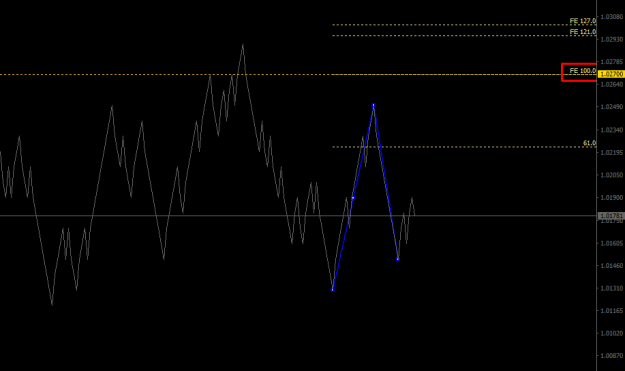

- Joined Jun 2016 | Status: Sharing EUR/USD Ideas and Insights | 9,040 Posts

Looking for profitable short term trades ...|

- Post #153,753

- Quote

- Aug 7, 2022 5:35am Aug 7, 2022 5:35am

- Joined Sep 2017 | Status: Member | 4,285 Posts

- Post #153,754

- Quote

- Aug 7, 2022 5:45am Aug 7, 2022 5:45am

- Joined Jun 2020 | Status: Member | 1,175 Posts

Another day, another dollar.

- Post #153,755

- Quote

- Aug 7, 2022 5:50am Aug 7, 2022 5:50am

- Joined Sep 2017 | Status: Member | 4,285 Posts

- Post #153,757

- Quote

- Aug 7, 2022 6:35am Aug 7, 2022 6:35am

- Joined Sep 2017 | Status: Member | 4,285 Posts