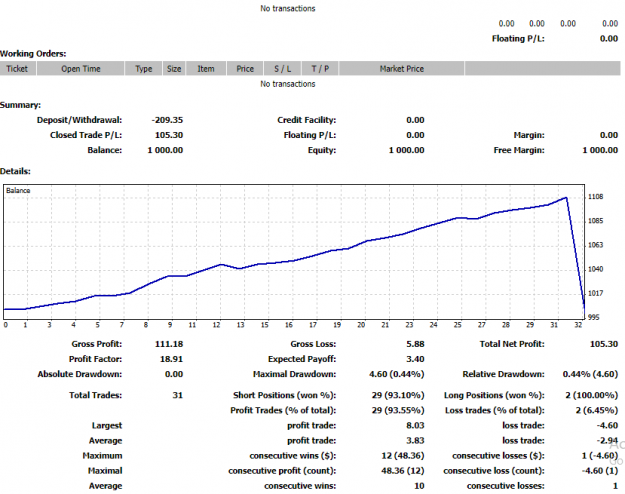

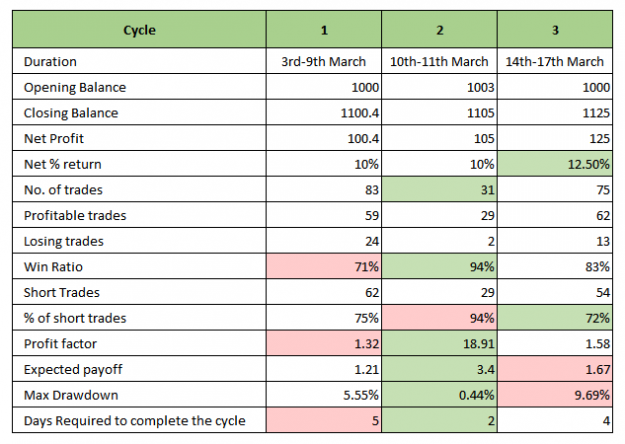

I am still thinking about the expected payoff of cycle 1. It was 1.21.

1.21 USD for a position size of 30 and 50 USD? I cant figure out what to do about it.

In the first cycle, what I did was, take a position and cut it immedicately after its not favourable for my trade direction anymore. But it also meant I had very very strict stop losses in most cases. Like 3 4 pips. Many of the trades I cut short could have been breakeven trades or maybe a small profit. How small? definitely more than 1.21 which is like 1 pip literally. But I also had to let go of some of the winners because I was afraid they will come back and go into loss.

That is what happened when my position size was about 3-5 % of my capital for each trade. What if I take smaller positions? If I can maintain the same expected payoff for each trade, it should be enough. But draw down will decrease for sure. Will try this from today. Smaller positions, bigger SL and bigger TP.

1.21 USD for a position size of 30 and 50 USD? I cant figure out what to do about it.

In the first cycle, what I did was, take a position and cut it immedicately after its not favourable for my trade direction anymore. But it also meant I had very very strict stop losses in most cases. Like 3 4 pips. Many of the trades I cut short could have been breakeven trades or maybe a small profit. How small? definitely more than 1.21 which is like 1 pip literally. But I also had to let go of some of the winners because I was afraid they will come back and go into loss.

That is what happened when my position size was about 3-5 % of my capital for each trade. What if I take smaller positions? If I can maintain the same expected payoff for each trade, it should be enough. But draw down will decrease for sure. Will try this from today. Smaller positions, bigger SL and bigger TP.