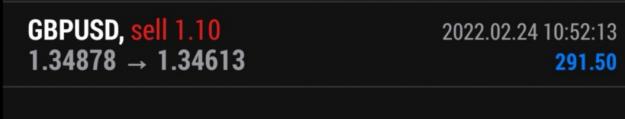

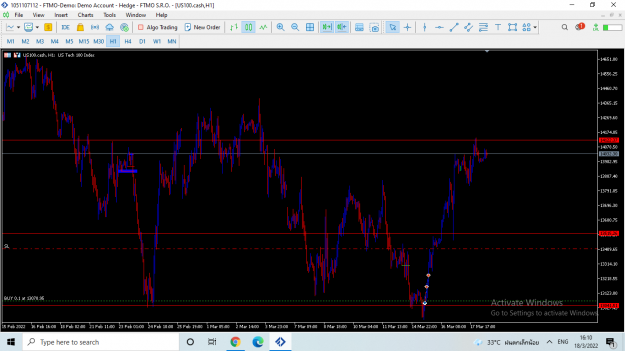

These both of your short trades is another level for me

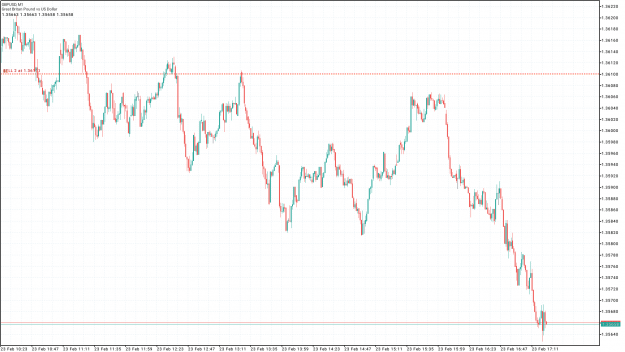

From ICT 2022 video , if I trade on that day, I would take a trade at the breaker after the BOS around 8:30 am NY time

( even so In the real time I would still unconfident in the trade. ) .

but your first sell position is even before the BOS at 8.30 occur and above my ideal entry 8 pips.

and your second entry is under my first target which look scary for me to trade .

SB