Disliked{quote} In other word you mean Corn is correlated to the mexican peso ?Ignored

1

Successful Fundamentals trading (DAY Trading WILL BE Ignored) 17 replies

second order ignored 0 replies

COT data question 0 replies

Disliked{quote} In other word you mean Corn is correlated to the mexican peso ?Ignored

Disliked{quote} Hi Kef, thank you for the info. I am new to this COT reporting, but it is great analysis, that helps to get an advanced knowledge of positions held. Which site is best to use? I've looked into these- CFTC.com TheIce.comIgnored

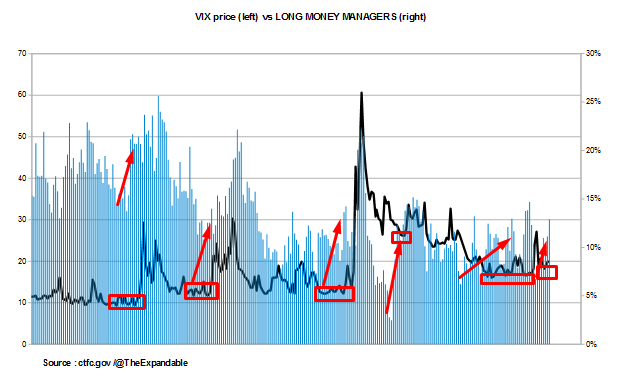

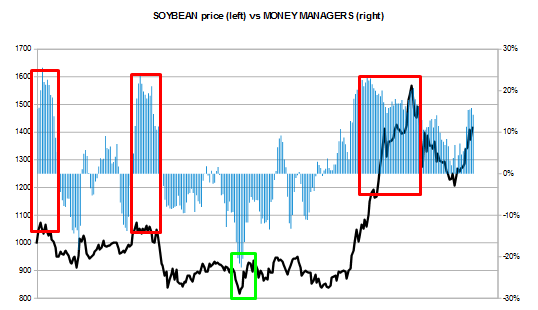

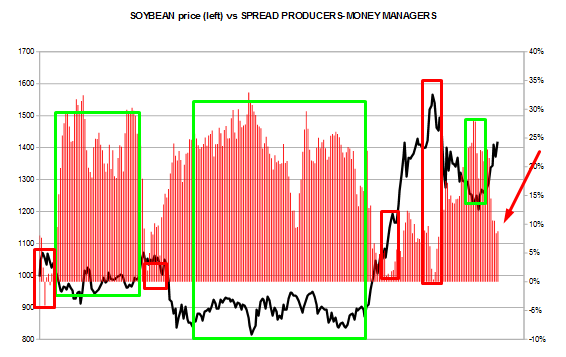

Disliked{quote} To me Smart money is clearly loading some good longs {image} Even Hedge funds are starting to buy the current bottom... {image}Ignored

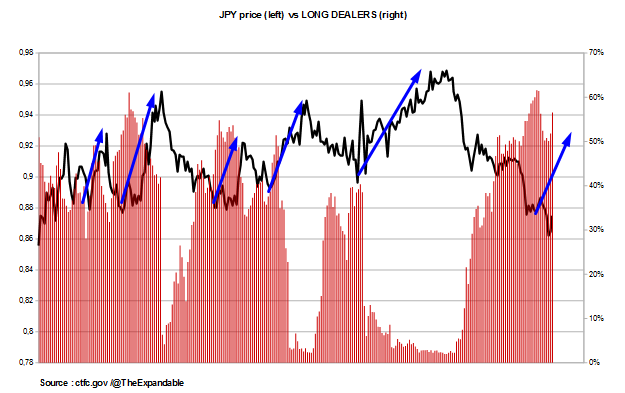

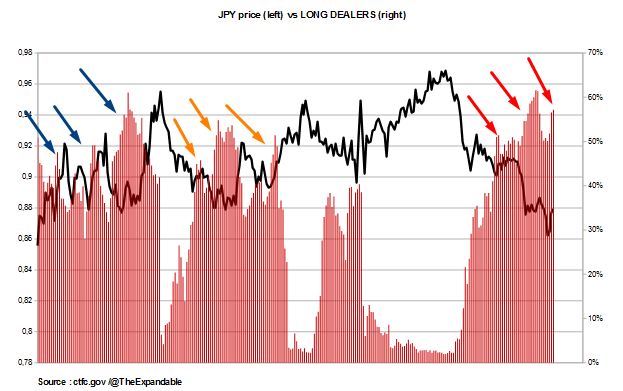

Disliked{quote} #jpy is ready for more upside ? {image} Everytime jpy long dealers have had such strong positions...jpy rallied between 400-600pts Imagine the help of dollar bears and you'll see usdjpy back to 99/104 #just sayingIgnored

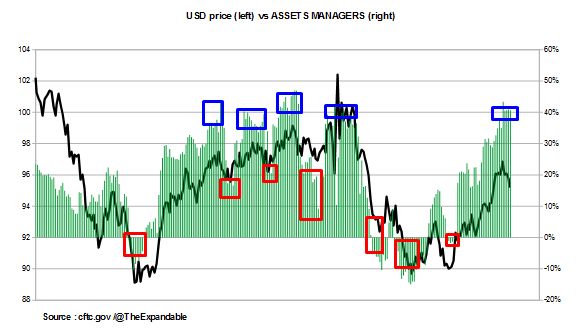

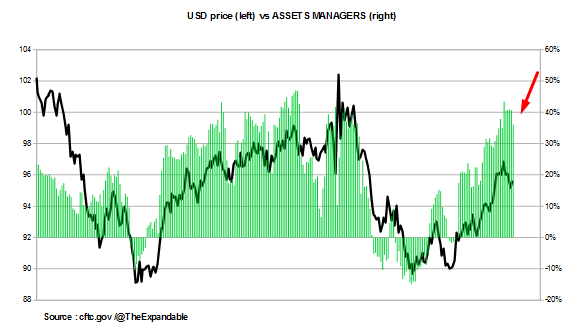

Disliked#dxy #usd more drop ? If you want to buy usd, i'd suggest to wait for a drop in the positionning of the assets managers. Being loaded this way usually lead to more unload {image}Ignored

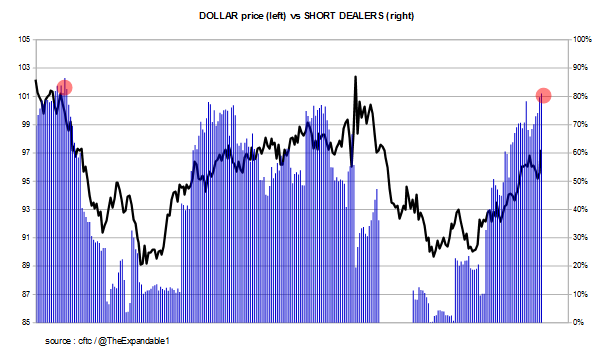

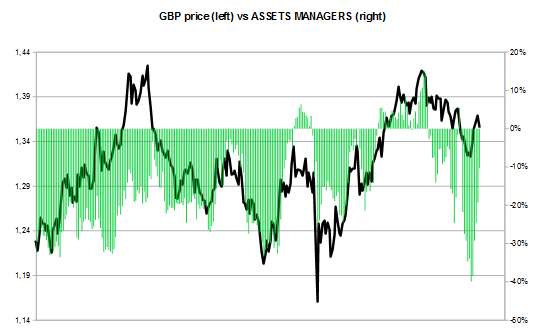

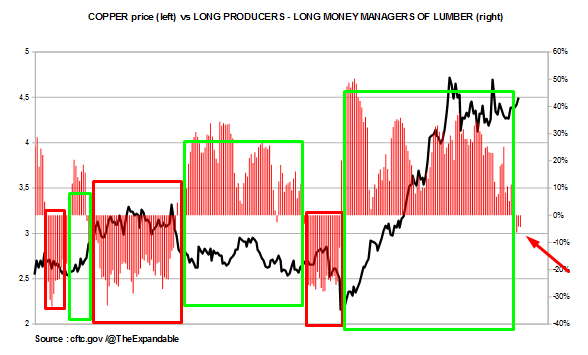

DislikedJust when you think Dumb money can't go deeper....they do! They are going almost -40% short, all in shorts {image}Ignored

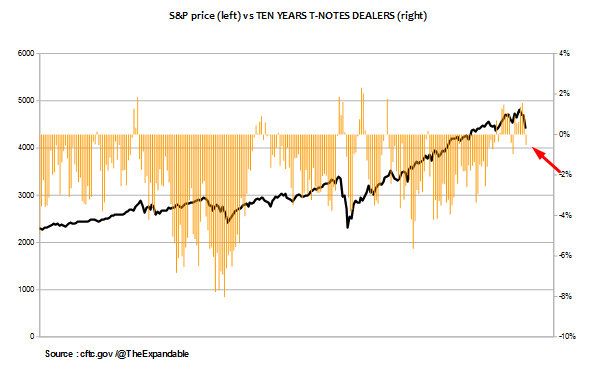

Disliked~vix (#spx #ndx) market correction not over yet ? You don't want to sell the vix, or buy stock market when short side of assets managers are still very loaded #just saying {image} Meanwhile....check the hedge funds (money managers). Looks like their strategy is to buy #vix now. Everytime it happened we have a rise, with a fall of stocks {image}Ignored

Disliked{quote} #gbp see how they are unloading their big shorts ? Perfect scenario, dips are still bought until AM goes long (or close to it) {image}Ignored

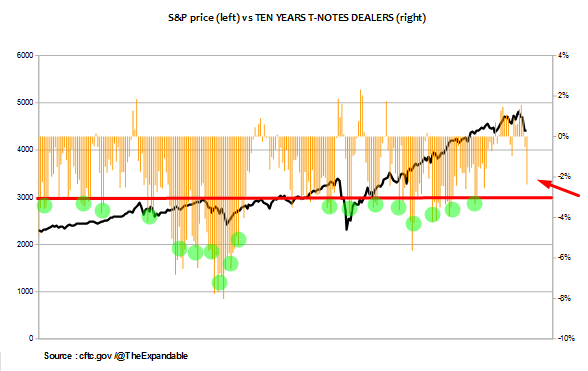

Disliked{quote} Drop happened in equities as expected 10 years dealers are now short...But small. Possible bounce, its still better to short rallies so far as i'd wait for the dealers to be net short at least 2%+ {image}Ignored

Disliked{quote} Its going as "planned" Assets managers start to unload their big longs I'd need more unloading from their part to buy #usd again {image}Ignored