Successful Trading using Fundamentals

The vision : To compete with the big boys. (Banks, Hedge funds, Mutual funds, Insurance companies, anything that is finance related)

The goal : Set a reasonable stop loss and allow profits to run consistently.

The plan : Using fundamentals to support and give reason for your trade.

What are fundamentals?

Investopedia definition:

The qualitative and quantitative information that contributes to the economic well-being and the subsequent financial valuation of a company, security or currency. Analysts and investors analyze these fundamentals to develop an estimate as to whether the underlying asset is considered a worthwhile investment.

For businesses, information such as revenue, earnings, assets, liabilities and growth are considered some of the fundamentals.

From the above statement in Forex trading terms, what it implies is that both the micro and the macro contributes to the economic well being of the country. Compare it with another country and you have a currency pair. Qualitative and quantitative information. Qualitative information represents micro details such as economic news. Quantitative is the overall behavior aspect of the market. The most basic form of Quantitative information is our charts.

Thread etiquette:

NO DAY TRADING POSTS ( I have lost enough money day trading and I am not afraid to admit it )

ONLY POST CHARTS WITH LONG TERM TECHNICALS. ( This thread is for medium to long term traders expecting to hold trades for more than a week. If you want to be taken seriously in this thread, do not post any chart with technicals that is under 1h. )

DO NOT POST RUMORS OR CONSPIRACY THEORIES. If you want, do SUPPORT IT WITH EVIDENCE. ( Trading with conspiracy theories will put you in a losing position. The Fed does not believe in conspiracy crap, so do the banks and other finance companies. Believing in this conspiracy or rumor crap means that you are trading the unknown. This is fundamentals trading, not conspiracy trading. )

USE SUPPORTING EVIDENCE OR DATA FROM REPUTABLE SOURCES. ( Do not post your hyperlinks from shady websites. If you want to be taken seriously, do it like the professionals in the finance related industry, using news sources from reputable companies. Ex. Bloomberg, CNBC, BBC, Financial Times, Nikkei (JPY news). )

To end of the opening introduction, here is a classic meme

The vision : To compete with the big boys. (Banks, Hedge funds, Mutual funds, Insurance companies, anything that is finance related)

The goal : Set a reasonable stop loss and allow profits to run consistently.

The plan : Using fundamentals to support and give reason for your trade.

What are fundamentals?

Investopedia definition:

The qualitative and quantitative information that contributes to the economic well-being and the subsequent financial valuation of a company, security or currency. Analysts and investors analyze these fundamentals to develop an estimate as to whether the underlying asset is considered a worthwhile investment.

For businesses, information such as revenue, earnings, assets, liabilities and growth are considered some of the fundamentals.

From the above statement in Forex trading terms, what it implies is that both the micro and the macro contributes to the economic well being of the country. Compare it with another country and you have a currency pair. Qualitative and quantitative information. Qualitative information represents micro details such as economic news. Quantitative is the overall behavior aspect of the market. The most basic form of Quantitative information is our charts.

Thread etiquette:

NO DAY TRADING POSTS ( I have lost enough money day trading and I am not afraid to admit it )

ONLY POST CHARTS WITH LONG TERM TECHNICALS. ( This thread is for medium to long term traders expecting to hold trades for more than a week. If you want to be taken seriously in this thread, do not post any chart with technicals that is under 1h. )

DO NOT POST RUMORS OR CONSPIRACY THEORIES. If you want, do SUPPORT IT WITH EVIDENCE. ( Trading with conspiracy theories will put you in a losing position. The Fed does not believe in conspiracy crap, so do the banks and other finance companies. Believing in this conspiracy or rumor crap means that you are trading the unknown. This is fundamentals trading, not conspiracy trading. )

USE SUPPORTING EVIDENCE OR DATA FROM REPUTABLE SOURCES. ( Do not post your hyperlinks from shady websites. If you want to be taken seriously, do it like the professionals in the finance related industry, using news sources from reputable companies. Ex. Bloomberg, CNBC, BBC, Financial Times, Nikkei (JPY news). )

To end of the opening introduction, here is a classic meme

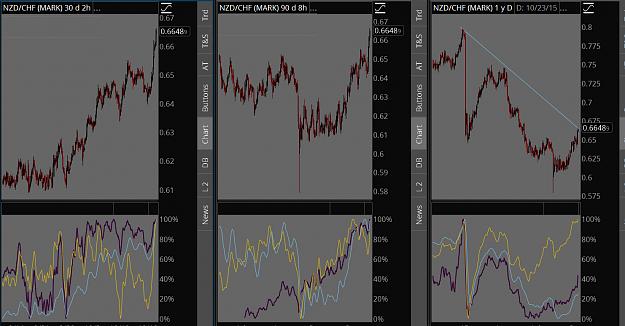

Attached Image