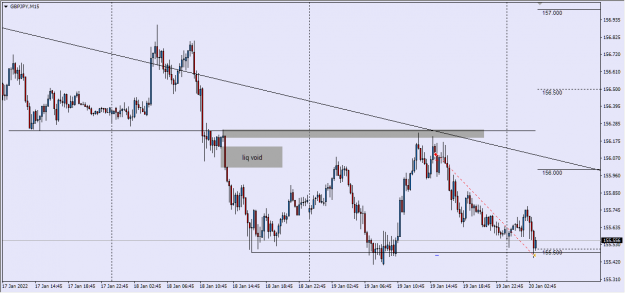

Disliked{quote} though i still have not got rid of the gbpusd losses, i managed to increase the return. {image}Ignored

reached my target of 20% per month.

now i have 4.2% of equity to play with in case of a loss.

i use all time (started 27dec21) because i was locked out of server for more than a week.

ITB - Seeing Orderliness amongst 'Randomness'

3