DislikedWe do not run a prop firm, BUT, we did just do a video with the COO of Eightcap. They seem to get a bad wrap in this thread for some reason, but for those interested it is worth a watch. Will give you some insights into who they are and the direction they are looking to head. Their company has went through a massive overhaul over the past 2 years. All of the previous management is gone and has been replaced with a lot of ex Pepperstone guys. https://www.youtube.com/watch?v=gnCtiY4H52I&tIgnored

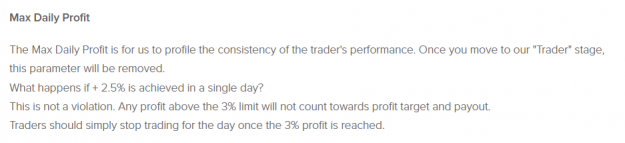

Tired of "Challenges" so have gone down the path of instant funders.

Two that stand out. https://dt4xtrader.com/ and https://www.forextradersuk.com/

Then there is a new one which is FREE . https://www.tentoptraders.com/ Don't know if I am good enough to make the 'Creme de la creme' short list, but free is free so I'll give it a go.

Look Left Trade Right

2