COT: The precious data ignored

- Joined Nov 2008 | Status: Full Time Trader | 10,519 Posts

Rule No.1: Never lose money. Rule No.2: Market is always right !

Successful Fundamentals trading (DAY Trading WILL BE Ignored) 17 replies

second order ignored 0 replies

COT data question 0 replies

Disliked{quote} JPY prices have been falling since start of Dec and accelerated from 20th Dec onwards. There has been a slight retracement today, but who knows, it could decide to keep pushing higher although I'd love to see them all retrace at least 50% of the move though predictions can never be so sweet.Ignored

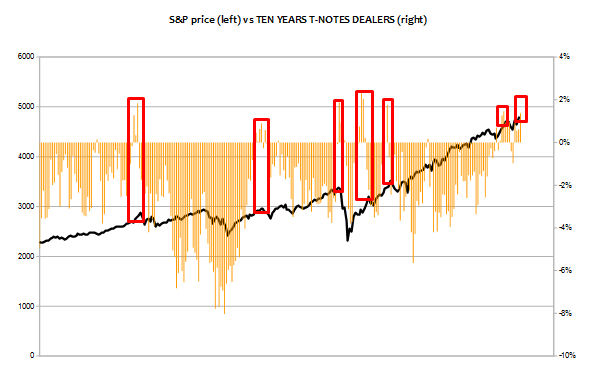

DislikedNew COT report tomorrow, but its important to see what's happening on the USD Hedge funds are clearly getting rid of their USD, it doesn't mean downtrend is coming ..... ....but you should do like they do: Selling USD rallies {image}Ignored

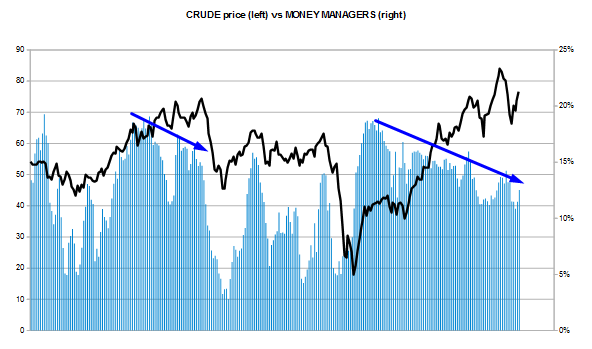

Disliked{quote} Interesting comparison. Hedge funds also moving funds into Oil sector, they predict further rise in Oil (WTI). Can we trust their move? What can you see on your side? So I looked in to this website where COT is available also, takes time to digest all the reports available. Thanks, JIgnored

Disliked{quote} Hello Jolita A few things about Oil. Its not something you can trust 100% regarding the COT report, but here is my stake {image}Chart above represents the producers. Net long or net short 1 / First mistake : Whenever they are massively short, you could expect more downside....But instead they clear their short, and price rises nicely (highlighted with red arrows) 2 / The "right" thing to do for producers would be to accumulate long contracts when it dips right ? that's what they did highlighted by the blue rectangle 3 / Check what they are...Ignored

DislikedHi Kuroro, Forgot to ask what time frame / period you've selected on COT report for Oil? ThanksIgnored

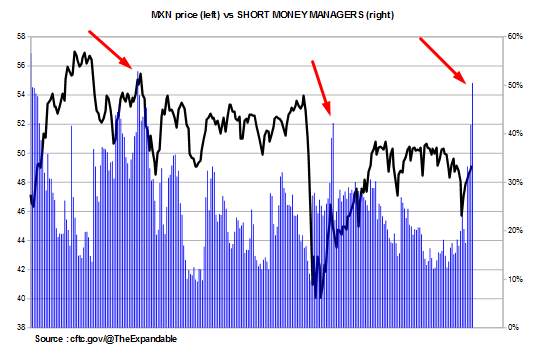

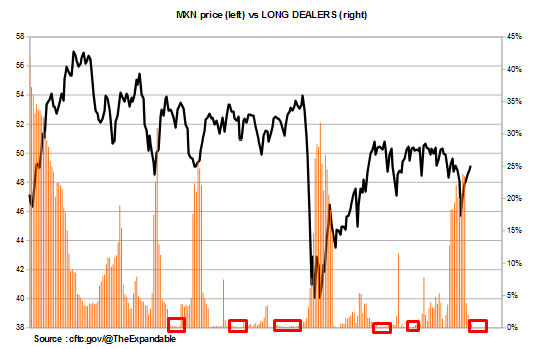

Disliked#Mexican peso I would suggest to start clearing your MXN longs because it doesn't look beautiful for the future First chart below represents the Assets managers, the short side. As you can see they are retreating off their big short as price rise. Big and quick retreat {image} Chart below represents the short side of the hedge funds. I don't tend to rely a lot of it as HF have a lot of different strategies. But their main strategy is to short the MXN for now, stay tuned {image} Last chart represents the long side of the dealers. They went from 20%...Ignored

Disliked{quote} Hi Jolita, COT is released once a week. The tool is most properly for time frame Weekly, for sentiment research to look for WHAT buy/sell. Lower time frame Daily/H4 depending WHERE you buy/sell. Still I am learning it how to read COT report but I really am grateful to Kuroro001 because thanks to this subject I am not lossy finally. I am faithful to the topic on this site. Thank you Sincerely KefIgnored

Disliked{quote} Corn is a strange cropJan Feb Harvesting Season - Planting starts March April - trend starts forming this is completely normal. {image}

Ignored

Disliked{quote} Hi Kef, thank you for the info. I am new to this COT reporting, but it is great analysis, that helps to get an advanced knowledge of positions held. Which site is best to use? I've looked into these- CFTC.com TheIce.comIgnored

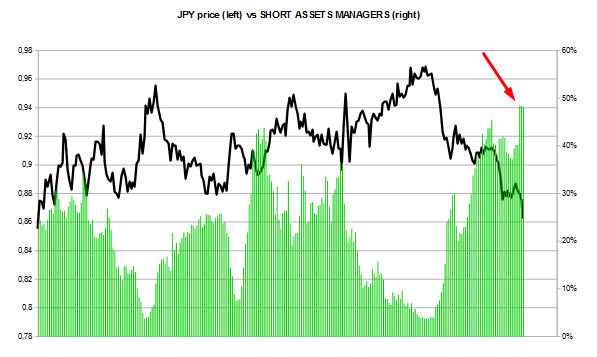

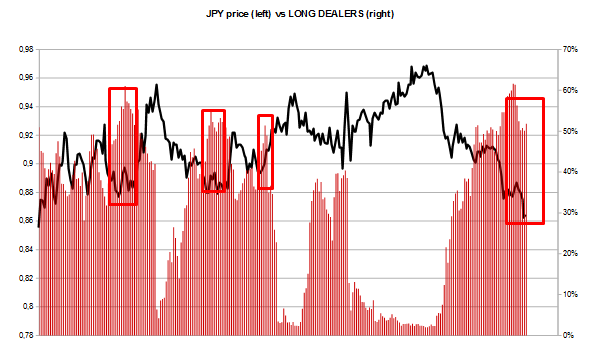

Disliked{quote} Not yet....SMART MONEY are increasing their SHORT POSITIONS on JPY {image}Ignored

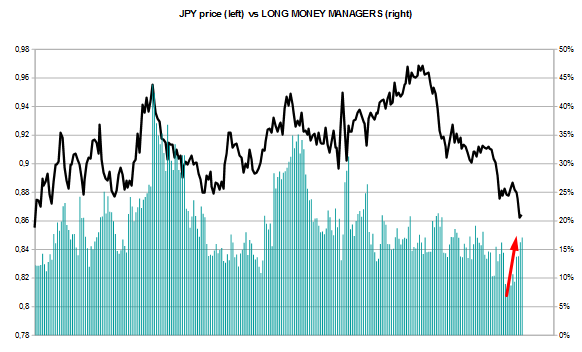

Disliked{quote} To me Smart money is clearly loading some good longs {image} Even Hedge funds are starting to buy the current bottom... {image}Ignored