Statistical arbitrage

1. About

Statistical arbitrage - is the mispricing of any given security according to its expected value, based on the mathematical analysis of its historical valuations. Statistical arbitrage is often involved with pairs trading.

A statistical arbitrage pairs trading position consists of a long position on one security and a short position on another security. On the forex market, we should open a long position in an undervalued currency pair and a short position in an overvalued currency pair.The profit will get during the moving currency pairs to their mean price.

For trading, we should use pairs with strong correlation and cointegration. Moreover, the change in the distance between these pairs must be stationary.

2. The main idea of the strategy

We must find such currency pairs that move in the same direction and have a strong relationship - correlation.

The correlation coefficient must be greater than 0.9.

Temporary divergences often occur between these currency pairs. The presence of such discrepancies can be identified using the coefficient of cointegration.

It should be no more than 0.05.

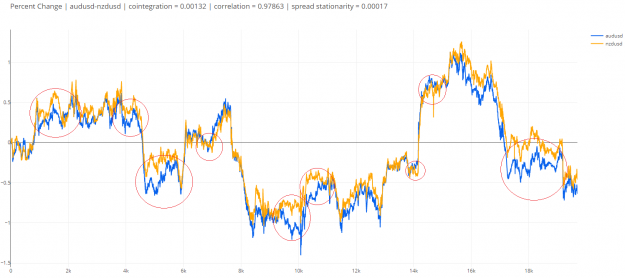

For example, currency pairs audusd and nzdusd. These pairs have strong correlation (0,97) and cointegration (0,00132).

Most of the time, these pairs move in sync, but sometimes there are small price divergences between them, which then quickly level out.

The purpose of the strategy is to find such moments of divergence between pairs and use them in trading.

3. How to determine the moment of divergence of currency pairs

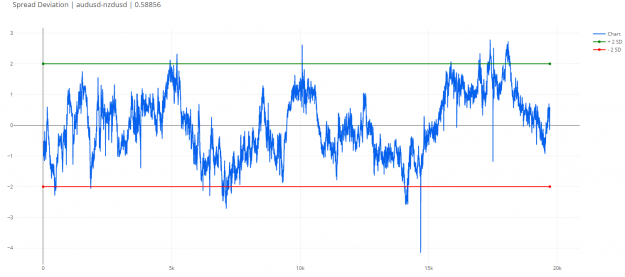

To determine the moment of divergence of currency pairs, a synthetic value is used, which is called the spread.

The spread reflects the relative difference between the change in the values of currency pairs. The average value of the spread over a certain period of time is calculated by the linear regression formula using machine learning algorithms.

If the spread value deviates by more than 2 standard deviations up or down from its average value, this is a trade signal.

4. Real Time Dashboard

To determine the correlation, cointegration and stationarity of the spread, I use the dashboard. It is free for everyone.

Link: forexpairtrading.com

5. Telegram channel with signals

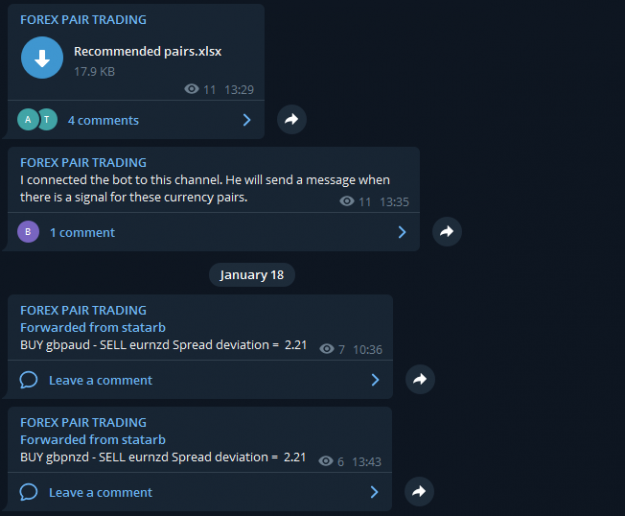

For your and my convenience, I launched a telegram channel.

When a trading signal appears, the bot sends a message to this channel.

LINK to telegram channel

6. YouTube channel

I talk more about this strategy with examples of transactions on my YouTube channel. Subscribe.

Link to my youtube channel.

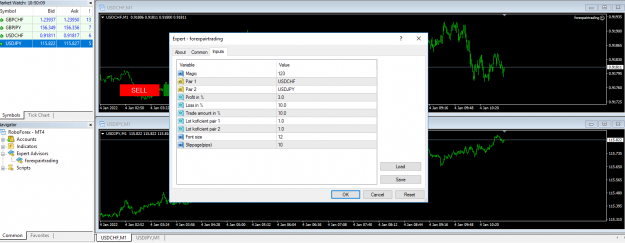

7. Trading panel

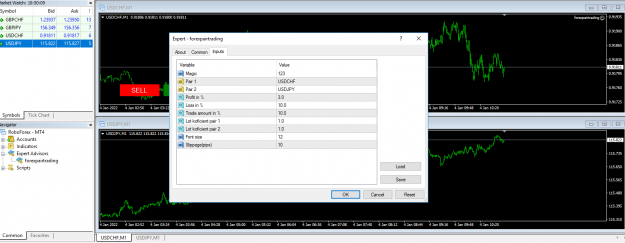

To make trades, I use the trading panel for the MT4 terminal.

Open two charts and tile them horizontally. Pair 1 set on top and Pair 2 on the bottom.

Magic - unique number for orders.

Pair 1 - set Pair 1 name like in your terminal.

Pair 2 - set Pair 2 name like in your terminal.

Profit in % - TP in % from account balance (summary profit from your orders (profit/loss Pair 1 + profit/loss Pair 2 + comissions + SWAP).

Loss in % - SL in % from account balance.

Trade amount in % - this is the position size in the deposit currency. For example, depo is 1000$. Trade amount = 10%. The money size for Pair 1 is 100$, and the money size for Pair 2 is 100$.

Lot coefficient help to tune the total trade amount in $.

Font size is tune letters size on buttons.

Slippage in pips - value for accounts with instant order execution.

Position open

If you want to BUY Pair 1 and SELL Pair 2 - press BUY button.

If you want to SELL Pair 1 and BUYL Pair 2 - press SELL button.

If you want to close positions - press CLOSE button.

Link to trading panel

Link to SET file (recommended settings)

Subscribe to my thread!

1. About

Statistical arbitrage - is the mispricing of any given security according to its expected value, based on the mathematical analysis of its historical valuations. Statistical arbitrage is often involved with pairs trading.

A statistical arbitrage pairs trading position consists of a long position on one security and a short position on another security. On the forex market, we should open a long position in an undervalued currency pair and a short position in an overvalued currency pair.The profit will get during the moving currency pairs to their mean price.

For trading, we should use pairs with strong correlation and cointegration. Moreover, the change in the distance between these pairs must be stationary.

2. The main idea of the strategy

We must find such currency pairs that move in the same direction and have a strong relationship - correlation.

The correlation coefficient must be greater than 0.9.

Temporary divergences often occur between these currency pairs. The presence of such discrepancies can be identified using the coefficient of cointegration.

It should be no more than 0.05.

For example, currency pairs audusd and nzdusd. These pairs have strong correlation (0,97) and cointegration (0,00132).

Most of the time, these pairs move in sync, but sometimes there are small price divergences between them, which then quickly level out.

The purpose of the strategy is to find such moments of divergence between pairs and use them in trading.

3. How to determine the moment of divergence of currency pairs

To determine the moment of divergence of currency pairs, a synthetic value is used, which is called the spread.

The spread reflects the relative difference between the change in the values of currency pairs. The average value of the spread over a certain period of time is calculated by the linear regression formula using machine learning algorithms.

If the spread value deviates by more than 2 standard deviations up or down from its average value, this is a trade signal.

4. Real Time Dashboard

To determine the correlation, cointegration and stationarity of the spread, I use the dashboard. It is free for everyone.

Link: forexpairtrading.com

5. Telegram channel with signals

For your and my convenience, I launched a telegram channel.

When a trading signal appears, the bot sends a message to this channel.

LINK to telegram channel

6. YouTube channel

I talk more about this strategy with examples of transactions on my YouTube channel. Subscribe.

Link to my youtube channel.

7. Trading panel

To make trades, I use the trading panel for the MT4 terminal.

Open two charts and tile them horizontally. Pair 1 set on top and Pair 2 on the bottom.

Magic - unique number for orders.

Pair 1 - set Pair 1 name like in your terminal.

Pair 2 - set Pair 2 name like in your terminal.

Profit in % - TP in % from account balance (summary profit from your orders (profit/loss Pair 1 + profit/loss Pair 2 + comissions + SWAP).

Loss in % - SL in % from account balance.

Trade amount in % - this is the position size in the deposit currency. For example, depo is 1000$. Trade amount = 10%. The money size for Pair 1 is 100$, and the money size for Pair 2 is 100$.

Lot coefficient help to tune the total trade amount in $.

Font size is tune letters size on buttons.

Slippage in pips - value for accounts with instant order execution.

Position open

If you want to BUY Pair 1 and SELL Pair 2 - press BUY button.

If you want to SELL Pair 1 and BUYL Pair 2 - press SELL button.

If you want to close positions - press CLOSE button.

Link to trading panel

Link to SET file (recommended settings)

Subscribe to my thread!