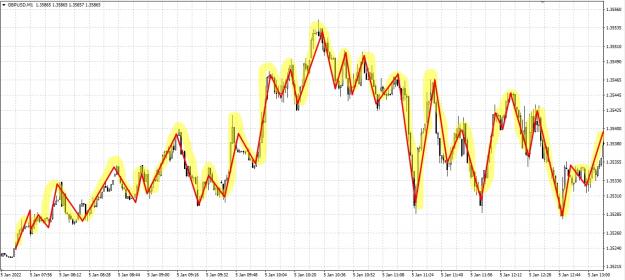

Just spent time on this intriguing thread, would like to ask what of the world Fx trading time widows are the best?, or at least the worst?

I am in the oceanic window. our SX opens at about 0830 AEST.

USFx opens about 11 PM, GBFx about 7PM.

Any suggestions I can try out?, I do not have a problem with overnight hours anyway.

I see that our AEST hours from 08 to 10 are very low ATR slope usually.

KenS

I am in the oceanic window. our SX opens at about 0830 AEST.

USFx opens about 11 PM, GBFx about 7PM.

Any suggestions I can try out?, I do not have a problem with overnight hours anyway.

I see that our AEST hours from 08 to 10 are very low ATR slope usually.

KenS