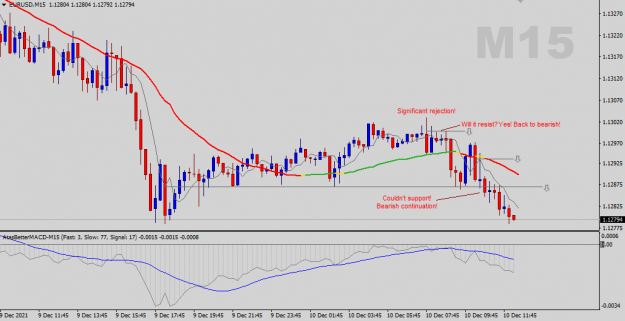

Disliked{quote} told y'all today will be tricky. could be a both a buy and a sell. buy at 1.12857 sell at 1.13326

Ignored

I used to find my views in agreement with those of Ata oftentimes but when not, it really got brutal with market direction (I made lots of money or avoided huge losses).

Let me tell you what I think is going on. The November 24 low is solid and a genuine yearly trend reversal. The rise that ensued was halted by big money to accumulate long / reverse. Until they are done, they won't let it go up.

Edit. You guys see the November 30 super fast drop?! To me that is big money telling people in unequivocal terms that the bitch ain't going nowhere! (That day I made 133% on account and it made my +96% week, because something didn't smell right to me at the top of the rise. https://www.forexfactory.com/thread/...6#post13807366 )

Temperance (restraint in action, thought or feeling) is a virtue.

2