Well two days in the books. 10 trades 8 wins 2 losses with one still open.

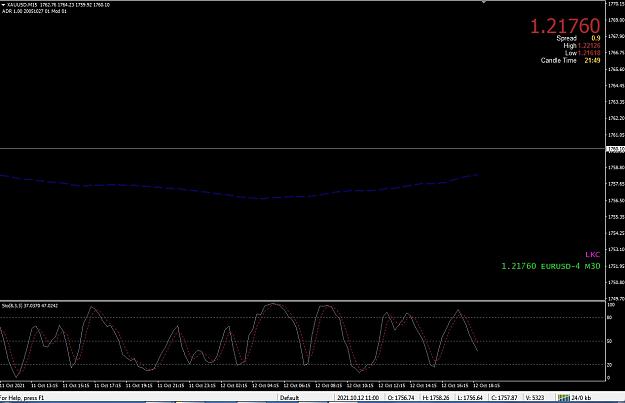

I have one question. When I have green crossing red I take the trade. I have been fortunate that the trades have been close to the 68 and 32 line of the TDI. My question is many times I have seen the cross but it is has been close to the 50 line. I have been passing on those trades thinking I will get less bang for the buck. I am correct in thinking that way? or, should I just forget where the cross happens and go for it. I noticed some folks don't even use the yellow line. I have been careful to make sure I am trading off of S/R an or the daily open line.

Any thoughts, corrections to my madness, and suggestions are much appreciated. have a great rest of your night.

I have one question. When I have green crossing red I take the trade. I have been fortunate that the trades have been close to the 68 and 32 line of the TDI. My question is many times I have seen the cross but it is has been close to the 50 line. I have been passing on those trades thinking I will get less bang for the buck. I am correct in thinking that way? or, should I just forget where the cross happens and go for it. I noticed some folks don't even use the yellow line. I have been careful to make sure I am trading off of S/R an or the daily open line.

Any thoughts, corrections to my madness, and suggestions are much appreciated. have a great rest of your night.