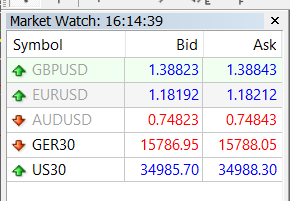

Disliked{quote} IS that MFF? I dont see the US30 spread that wide. Its 160 right now.Ignored

Dax is at 110 most of the time

1

prop firm new model - my trading journey 871 replies

Anyone trading with a Prop firm 2 replies

So I accepted a Prop Trading job in South Beach Miami 43 replies

Disliked{quote} IS that MFF? I dont see the US30 spread that wide. Its 160 right now.Ignored

Disliked{quote} I see the spread on US30 at 260 more often than not Dax is at 110 most of the timeIgnored

Disliked{quote} They are mentioning funding but it's buried deep under a lot of other "talkings" and no details about the conditions. {image} {quote} Yeah, they have got some XP points you can exchange for something. One can earn XP points by learning but XP can be also bought.... {image} Let's see how they show up... I found they use some obscure broker I never heard of before Forex Broker | CFD Trading | 1Market Even though 1Market offers MT5 platform but so far the Queensway does not seem to be a reasonable choice...Ignored

Disliked{quote} I see the spread on US30 at 260 more often than not Dax is at 110 most of the timeIgnored

Disliked{quote} I see the spread on US30 at 260 more often than not Dax is at 110 most of the timeIgnored

Disliked@pipmaster77 I was little suspicious about your comment about prop firms with 4%DD and that it is more profitable to use fee and trade it in personal live account. So I decided to do proper calculations to convince myself. Here are the numbers (I hope I haven't made any mistakes). I'm using CTI $70K account as an example. Result = you were right, 2x growth plan is amazing marketing tool. I hope this will help others to make it easier to visualize the comparison between choosing this particular prop model and using fee in your own personal live account....Ignored

DislikedLet's say you are risking 2% per trade with 2:1 reward:risk model on your own account, and you are doing well and your account is growing. You're trading 4H charts and maybe taking 2 or 3 trades a week. Swing trading. Making money with a prop firm seems simple in this scenario. Just take a few hundred pounds/dollars/whatever from your main account, and get started with something like the 5ers at the lowest priced account. All you have to do is this. When you enter a trade on your main account, just enter the same trade on your prop firm account....Ignored

Disliked{quote} Be sure to test out your strategy on a demo account as many times as you need to feel confident. Theory is the easy part, flawless execution is the difficult part, especially if a few losses come your way back to back the temptation to revenge trade with inappropriate lot sizes will raise its ugly head. At the end of the day if you think you are ready and you don't care much about potentially losing the risk capital/Prop Firm fee then go for it. By all means show a TE if you wish and trade your way to victory. Best of trading to you, Masterrmind...Ignored

Disliked{quote} {image} It has been said many times that 5ers and CTI models, where fee is = or > than available DD is not worth it. You can even see I made a spreadsheet proving that you're better off putting money in your own account and trade it. Numbers don't lie and difference after few levels is significant. Let me play devil's advocate with my own earlier opinion about such model and provide counter-argument saying that this model does have advantages. First, it is better to trade other people's money from psychology point of view. Trading your own...Ignored

Disliked{quote} Still doesn't work out better, even when you withdrawal monthly, however, the not having your own money at risk advantage is huge. Here is an example I posted quickly on Sunday. I am trading 4 accounts so do not have time for a spreadsheet. Since you already created the spreadsheet, for the good of the thread, could you add a column showing a withdrawal at each stage of equal amount (prop and personal account) So, for $979 MFF, I get 20K account with 5% ($1,000 DD) or I put the $1,000 in personal account. For simplicity, let's assume a 500...Ignored

Disliked{quote} You gonna do the MFF challenge thing they are releasing soon where winner skips phase 2? I am thinking about doing it for the ego pointsIgnored

Disliked{quote} Yes, my only concern is it throwing me off my "slow and steady" pace in an attempt to try to beat them. So I'll keep my risk the same and see what happens. If I read correctly, I believe we are against other traders as well. It was a great idea to put max sizes in there, but I still feel someone with one lucky trade will win.Ignored

Disliked{quote} Based on my interactions in discord, I would say most of the traders who are trading in that competition will break the rules due to open size at once or no stop loss. But thats just me being a bitch.Ignored

Disliked{quote} I only trade session time, so I don't know outside session time. Not sure why someone would trade US30 outside of session tbh.Ignored

Disliked{quote} Thanks. I don't really use the Forums, but came across this thread as part of my prop firm research. I've been reading through the thread, seen TE mentioned a few times. I assume it's some kind of record of trading performance. Can you elaborate a bit please? Thanks.Ignored