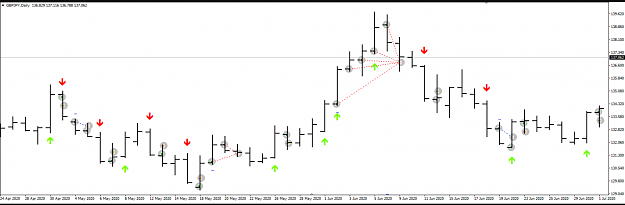

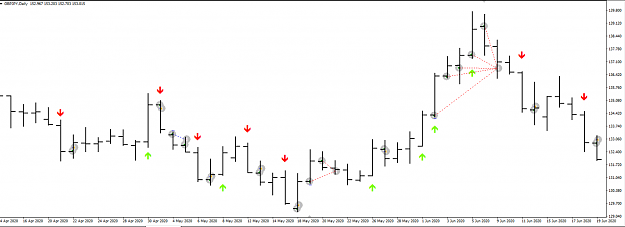

Dislikedyes, the DOS EA set up on every single trade chart, and the trade manager on one single separate chart that manages all the trades as a basket. {file} {file} NOTE: This setfile is for the trade management EA, *not* for the DOS EA. Remember to delete the .txt suffix from the setfile. blam {quote}Ignored

where can I find the DOS -EA? thx in advance for the help!

Nice thread and super work Smile! thx for your help .. REALLY!