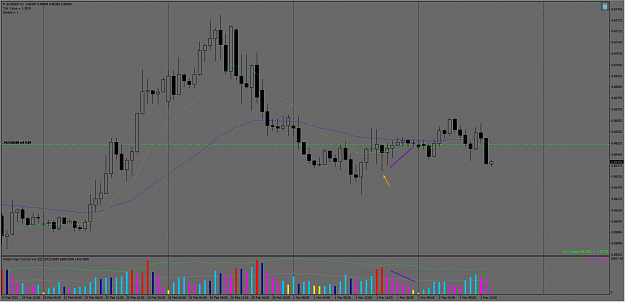

My short entry for GBPUSD .... this is the last time i will inform here about my entry ... if someone is interested then just subscribe my thread because i dont want make a double posting ... sorry i'm a bit lazy ....

https://www.forexfactory.com/thread/...6#post13406296

https://www.forexfactory.com/thread/...6#post13406296

1