DislikedSpace, Time & Ergodicity When you first look at a price chart, you see that we are watching price evolve over 2 axes, price and time. And as you watch the price trade, it appears that these 2 axes are linked and are moving together. ButÖ are they really? When you step back and think about it, you will find that the 2 axes are completely different, in terms of their drivers. The time axis moves along at whatever constant rate you arbitrarily selected while the price access is entirely driven by actual orders trading over the bid-ask spread. For some,...Ignored

I do see what you are saying about the price axis, driven by buying and selling

The following example you had given though... Yes, the expected value is positive if we look at the expectancy. However, there is failure to check if we can play the game enough times to make use of this positive expectancy in the long run. I do not think this was demonstrated and it was not clear if 40% of initial amount or 40% of current balance is used.

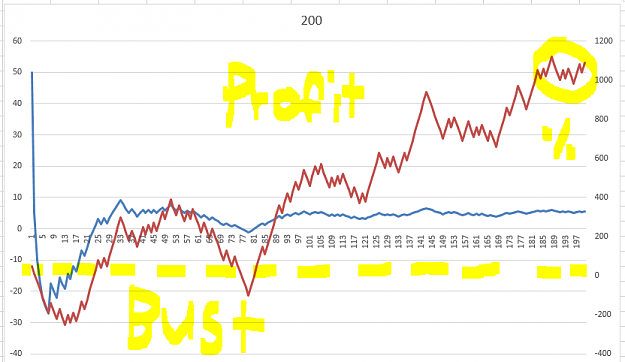

If one was to play this game, common sense should have triggered and said: 'Hey, 50% chance...If I lose 40% each time, how many times can I play (if risking 40% of initial value each time)?' It would be 2 times..and then one would go bust... Then considering what would be the likely chance we would see 2x losses in a row when we first start to play... Well, 0.5 * 0.5 = 0.25...meaning that we would have 25% chance to go bust if we start playing this game right in the first 2 trades... However, if one does not mind going 'bust' a few times and starting again; It should make profit in the long run from what I can see in my example, if the risk remains 40% of initial investment (since we are not just talking about a random 40%, but 40% of something).

If the example was risking 40% of current balance, then I would say the average expectancy may not be calculated accurately as now the weightings of each 'trade' are no longer in balance. My rough estimate is that it will be a range from -75% to 600% using 100 trade sample sizes...So the expectancy would look exponential/ parabolic and luck will determine what way it goes it seems ^_^

"Only you can Make the Future you will be proud to be a part of..." -Me

2