Viewing the market through f(x)

100-200MA 1 Hour Time Frame 327 replies

USDJPY pulling back to 200MA 2 replies

Trading 24 hours per day, 5 days per week 14 replies

DislikedOnce spreads tighten again after the close will be looking to get short NZDUSD. Set up looks really nice... {image} Need to free up some margin though so we will see...Ignored

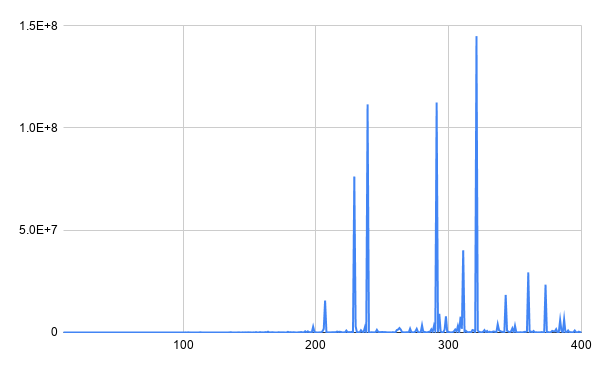

Disliked{quote} Yes that looks like money to me. Forgive my mixing of terms, since we are below MA, we want a lower high, which comes just after your horizontal line. Selling 20-40 pips from that peak looking 1:4 to 1:1.5 RR (depending on where in the 20-40 pip range you are in) is a good entry imo. I am in that same short. {image}Ignored

Disliked{quote} How do you determine the SL for your trade? Seems to be at / near the 200 MA line, correct?Ignored

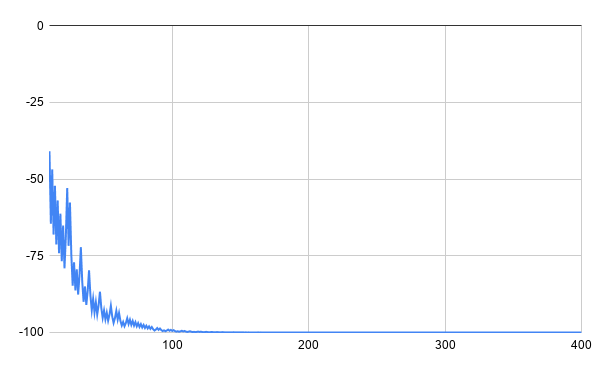

Disliked{quote} CADCHF hit TP so I finally freed up some margin. NZDUSD still looking pretty ripe. Shorting here. Probabilities suggest we have about a 40-50% probability of profit with this one. Time will tell though! {image} Can almost see the 3rd leg of what most would call a 123 pattern getting ready to form. Shorting the pullback rollover with the trend is always a decent bet!Ignored

Disliked{quote} Spiked. USDJPY will likely stop soon. When margin is free may long some GBPJPY...Ignored

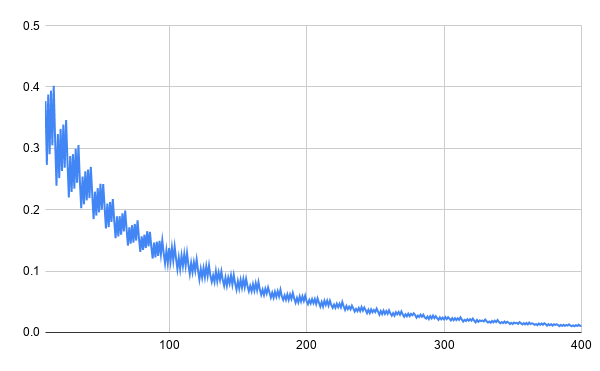

DislikedSpace, Time & Ergodicity When you first look at a price chart, you see that we are watching price evolve over 2 axes, price and time. And as you watch the price trade, it appears that these 2 axes are linked and are moving together. ButÖ are they really? When you step back and think about it, you will find that the 2 axes are completely different, in terms of their drivers. The time axis moves along at whatever constant rate you arbitrarily selected while the price access is entirely driven by actual orders trading over the bid-ask spread. For some,...Ignored

Disliked{quote} Uhh. I understand some things in your comment. Could write this in normal people lamguage? ( 0.5-0.5)? what is first 0.5 ? and second 0.5? (0.5-0.4) what is 0.5? and what is the most o important in this comment?

Ignored

DislikedIve seen charts here with volume being used on FX pairs? There is NO centralized trading desk in forex so the only volume you get is from YOUR brokers volume.Ignored

Disliked{quote} It will end up being near the 200 MA line but basically, you want it above the swing high. I personally do 10 pips above the close of the marked candle in the image and you will see why later when we go into the data, but again, it works out to be basically above the swing high + some extra.Ignored

Disliked{quote} Could write this in normal people lamguage? ( 0.5-0.5)? what is first 0.5 ? and second 0.5? (0.5-0.4) what is 0.5?

Ignored