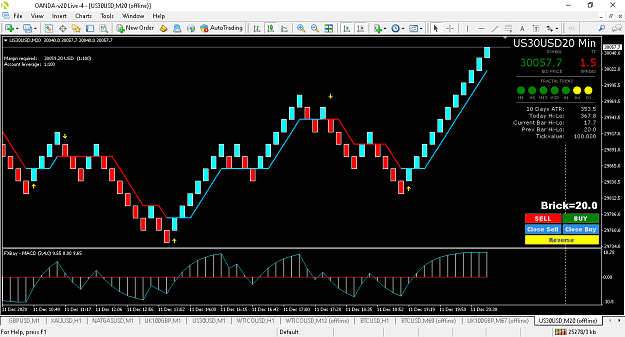

Disliked{quote} I stopped trading USDDKK with OANDA because of too many spikes but OANDA is great for CFDs.Ignored

- Post #6,422

- Quote

- Jan 17, 2021 11:39am Jan 17, 2021 11:39am

- Joined May 2016 | Status: Member | 4,233 Posts

- Post #6,423

- Quote

- Jan 17, 2021 12:08pm Jan 17, 2021 12:08pm

- | Joined Aug 2015 | Status: Member | 489 Posts

- Post #6,424

- Quote

- Jan 20, 2021 5:23am Jan 20, 2021 5:23am

- | Joined Mar 2018 | Status: Member | 518 Posts

Be humble or get humbled

- Post #6,425

- Quote

- Jan 20, 2021 6:08am Jan 20, 2021 6:08am

- | Joined Aug 2015 | Status: Member | 489 Posts

- Post #6,427

- Quote

- Jan 20, 2021 7:02pm Jan 20, 2021 7:02pm

- | Joined Mar 2018 | Status: Member | 518 Posts

Be humble or get humbled

- Post #6,428

- Quote

- Jan 22, 2021 4:07am Jan 22, 2021 4:07am

- Joined Nov 2008 | Status: Member | 2,011 Posts

- Post #6,430

- Quote

- Jan 22, 2021 4:30pm Jan 22, 2021 4:30pm

- Joined Apr 2010 | Status: Lazy trader on D1 charts | 5,906 Posts

- Post #6,433

- Quote

- Jan 27, 2021 3:17am Jan 27, 2021 3:17am

- Joined Nov 2008 | Status: Member | 2,011 Posts

- Post #6,434

- Quote

- Jan 27, 2021 12:13pm Jan 27, 2021 12:13pm

who dares wins

mashFX DSRII Return This Year:

na

- Post #6,435

- Quote

- Jan 27, 2021 1:58pm Jan 27, 2021 1:58pm

- Joined Apr 2010 | Status: Lazy trader on D1 charts | 5,906 Posts

- Post #6,437

- Quote

- Jan 28, 2021 3:20am Jan 28, 2021 3:20am

- Joined Nov 2008 | Status: Member | 2,011 Posts

- Post #6,438

- Quote

- Jan 28, 2021 2:16pm Jan 28, 2021 2:16pm

- Joined Apr 2010 | Status: Lazy trader on D1 charts | 5,906 Posts

- Post #6,439

- Quote

- Jan 28, 2021 3:22pm Jan 28, 2021 3:22pm

- Joined Nov 2008 | Status: Member | 2,011 Posts

- Post #6,440

- Quote

- Feb 6, 2021 9:53am Feb 6, 2021 9:53am

- Joined Nov 2008 | Status: Member | 2,011 Posts