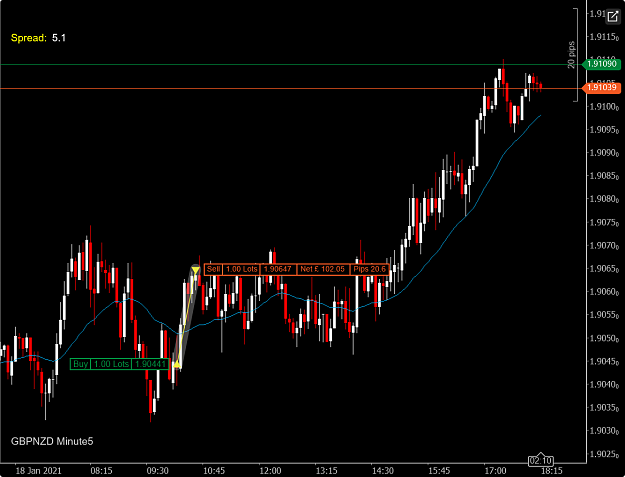

mate, keep sharing, I totally get it... hedging and hedging/DCA (I think its a mix, right ?) when doing right cannot be beaten, just simple math. that is not for everybody for sure, need to know how to trade profitably in the first place but now putting a 25-30 pips stop loss when you have better way to manage trades seems stupid to me... thank you for opening my eyes

- Joined Jun 2016 | Status: Sharing EUR/USD Ideas and Insights | 9,018 Posts

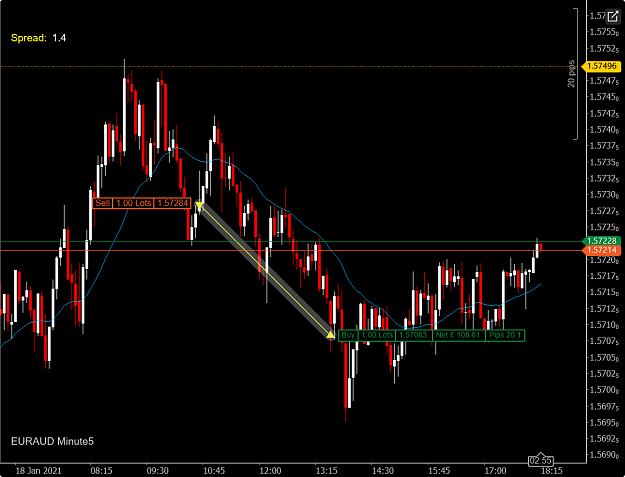

Looking for profitable short term trades ...|