if you are trading stocks EOD then the best volume data feed is ETO options data to superimpose and replace equity volume ... volume analysis really performs well with this as the options market (professional trading) always precedes the equities market

if you want forex EOD then a better data feed is to take futures continuous back adjusted and with a bit of thinking and manipulation you can create for example an accurate EURUSD data feed from two futures feeds

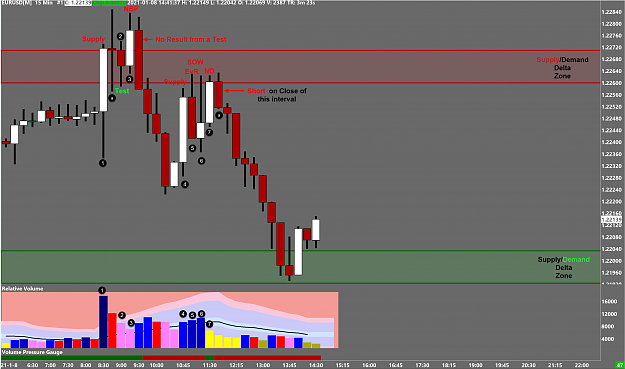

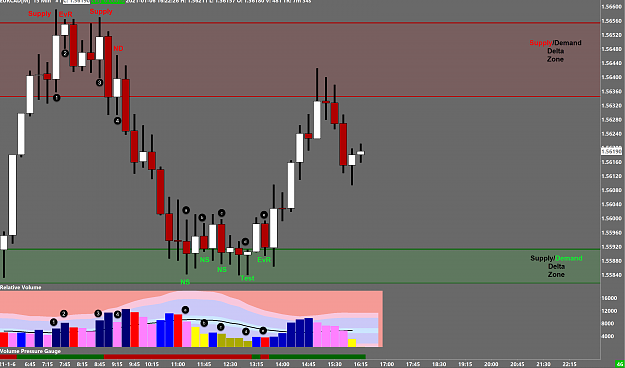

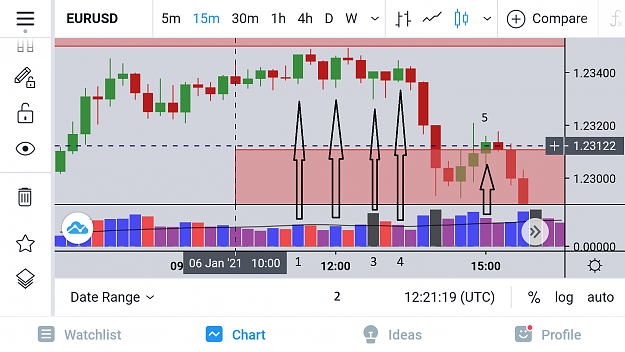

Forex intra day it is best to use one of the major brokers feeds say Oanda or FXCM ... sign up with a small live account and you will get real data ... its perfect of trading volume analysis

if you want forex EOD then a better data feed is to take futures continuous back adjusted and with a bit of thinking and manipulation you can create for example an accurate EURUSD data feed from two futures feeds

Forex intra day it is best to use one of the major brokers feeds say Oanda or FXCM ... sign up with a small live account and you will get real data ... its perfect of trading volume analysis

1