Disliked{quote} Like I said before, anyone who challenges your big ego, just cut em down, try and silence them, how predictable, I guess that's all we can expect from you now.Ignored

I like this post from by trading buddy Steve (robots4me) so I thought I would post it here as well. Hope Steve doesn't mind.

@PeterCaleb -- you joined FF middle of last month and are already going on 200 posts. Since joining you post 10-20 times every day. After all those years as an "experienced trader" what bug crawled up your ass on Nov. 17, 2020 that caused you to proclaim your new mission in life was to share your wonderfulness with all the poor, struggling traders at FF?

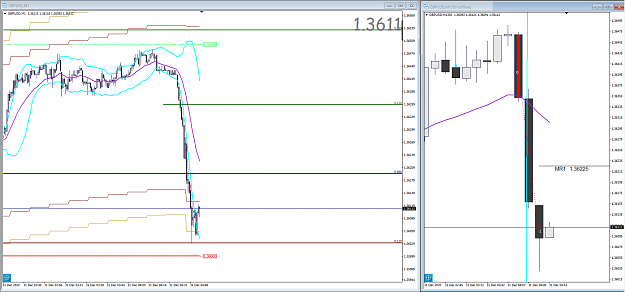

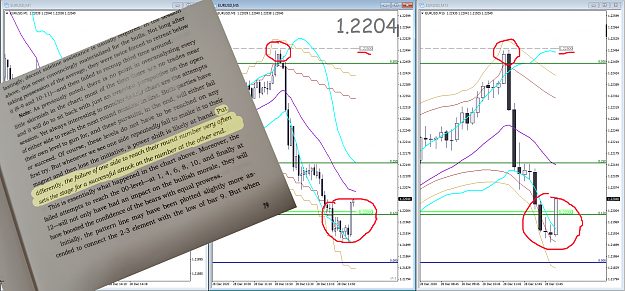

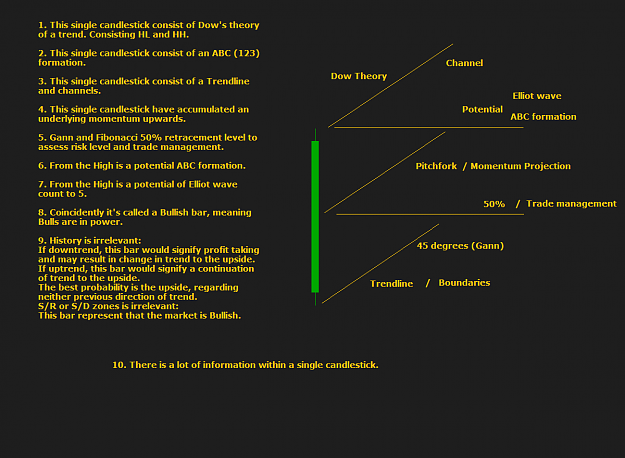

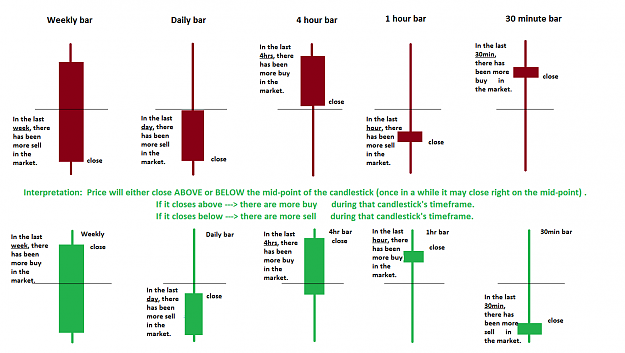

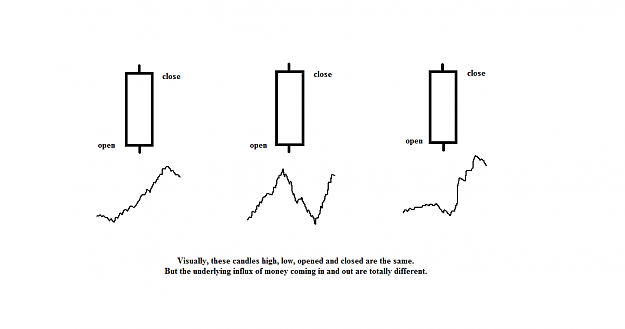

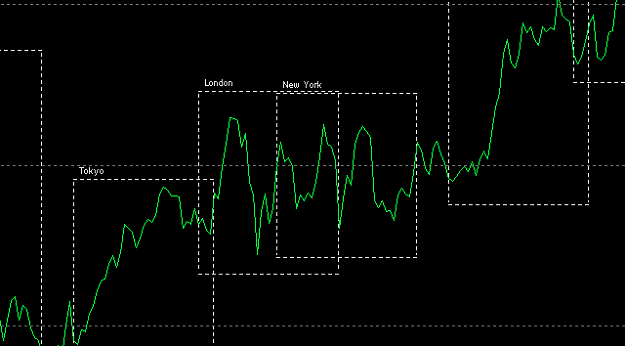

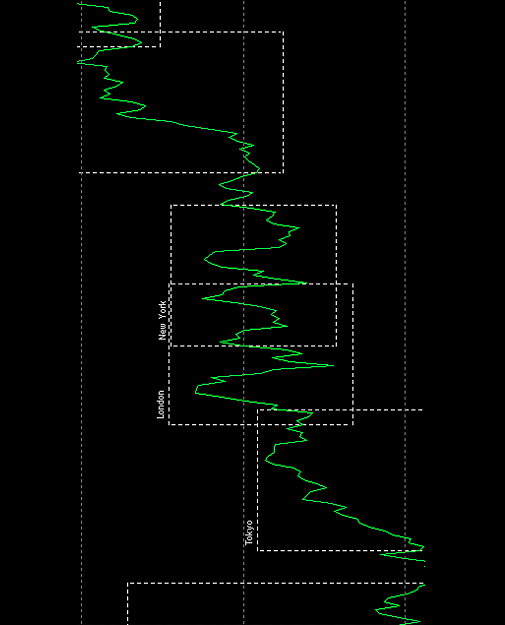

Trading thin liquidity at the boundary of the charts

1

5