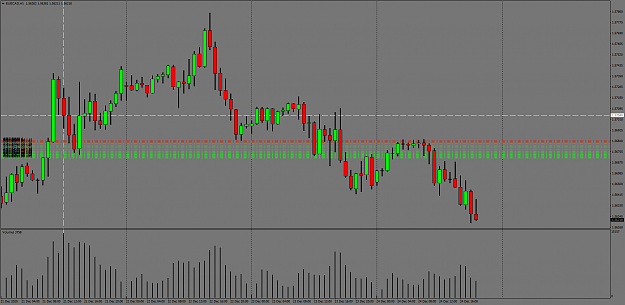

That not what Tom or Sebastian said

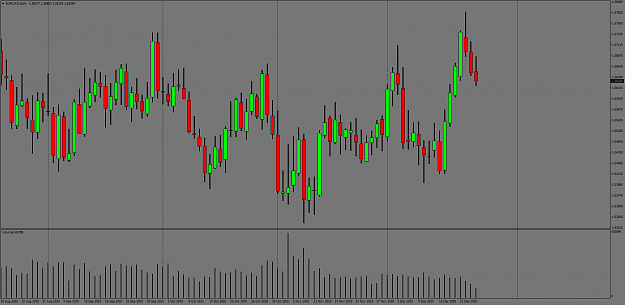

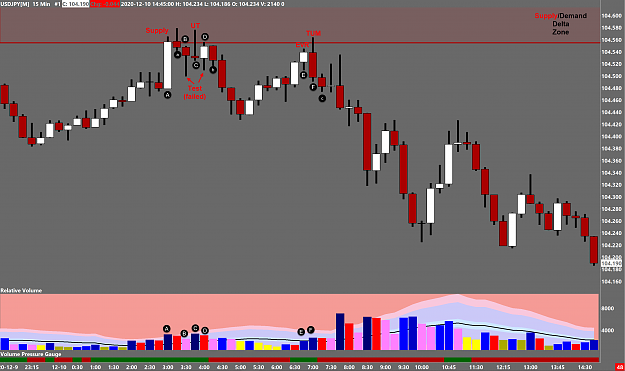

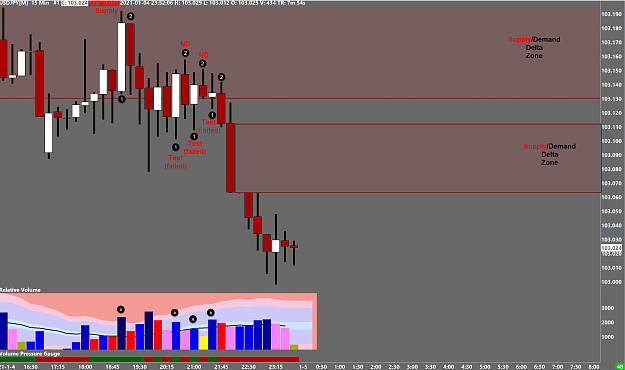

A test is a test is a test

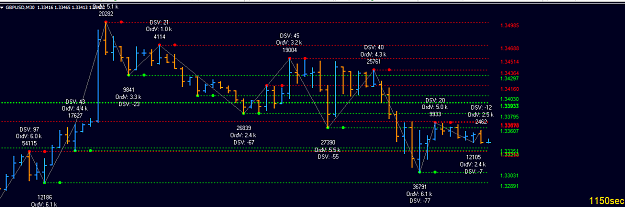

The reaction to it is the important point

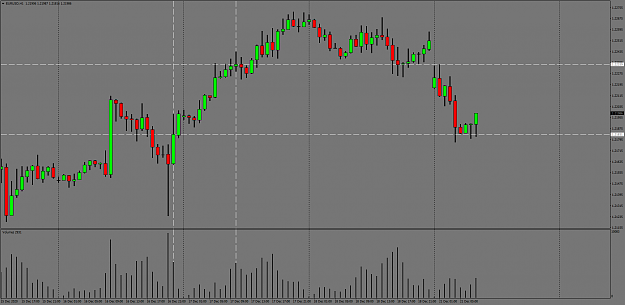

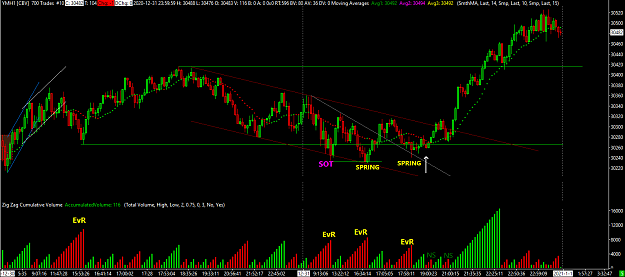

Simply it passes the test or fails and then steadily moves up on diminished volume preferably

A test is a test is a test

The reaction to it is the important point

Simply it passes the test or fails and then steadily moves up on diminished volume preferably