This morning I was thinking about the first time I felt the need to improve my trading performance without doing more trades. And one of the earliest memories I have of what helped me was trailing my active stop loss. These days there's so many options and strategies. And so many ways to say it, speak of it and "talk about it". Well, I like to keep it real and honest. I am aware that people like to use EA's to help "manage" their trades and like to use all the fancy tactics that these offer. But for me, when MY money is on the line, I consider myself MUCH better than an EA. Why? An EA can break down, malfunction, or just stop working for some known or unknown reason. However if I malfunction, there's a good chance I need to see a doctor.

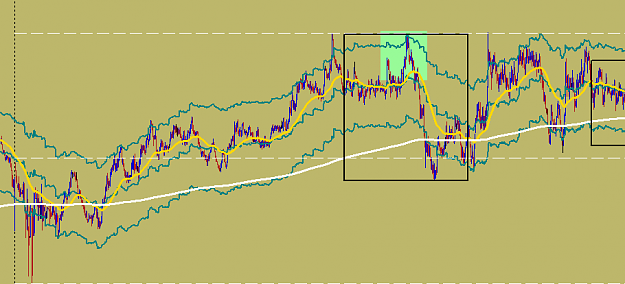

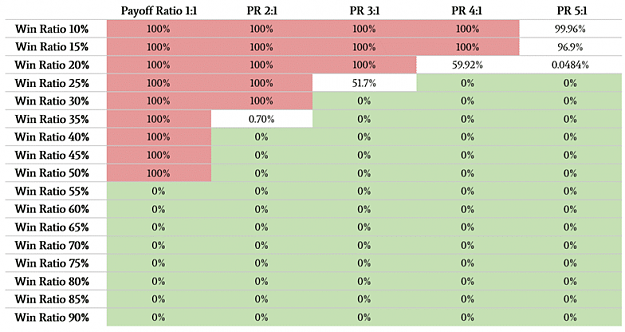

So it got me thinking. What WAS my favorite way to trail that damn stoploss? I use the "first hit is my fault, second hit is their undoing" strategy. I suppose you've come across R's. And R:R. So if you haven't here goes ... you want to place a trade. You can afford a 10PIP stoploss for a move with the potential of triple return. That equates to = 10:30 approx. Risk 10 to make 30. And we''ll say this is gross return, before transaction costs. However, there's the other way to do this = 3:1 .... 30:10. Why reversed? Sometimes the market backs itself into a "corner" and has to claw at the situation to get away. And if you watch the 1 MINUTE chart at any length, you'll sometimes see the market initially make a great move up or down into that zone making numerous very high or very low points bunched or maybe spread out, within a certain "price zone". Some call it congestion, some call it other things.

(UNLESS YOU are the driver of that market you are watching, truthfully you have little chance of knowing for certain the WHY. BUT, you CAN summize by evaluating lots and lots of situations where this is happening in the same kind of way. And THIS is HOW you learn to trade properly. Repetition WITHIN a market's view but WITHOUT a story to deceive you. You are a trader so you have to be truthful. YOUR goal is to sort out fact from fiction to the very best of your ability.)

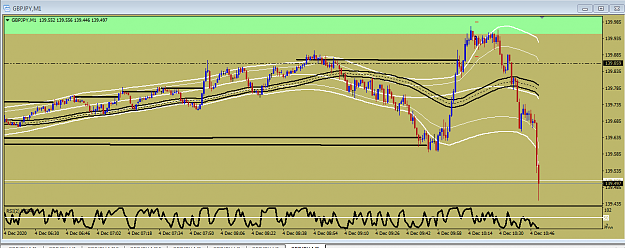

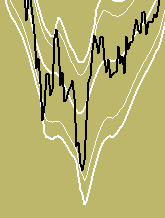

So why risk more than you might make? Although the market you trade may seem like a psychopath going all over the place at times, it does possess a sense of Rhythm and order. I am aware that some people have started trying to take advantage of things like the Oanda Order book and the order book concept in general. In my experience these things are false gods. They do more harm than good. They aren't really a blueprint, they merely have people become addicted and very dependent on an outside "tool" rather than relying on themself. So what does all this have to do with a reversed trade risk position? The people who try and take advantage of order book data are trying to "see into" the situation I mentioned earlier about the market cornering itself. It's to do with "Order Flow" and the fluidity of the market. Although most people complicate it far too much, in my opinion. And "Price action", Oh, you gotta love all these buzzwords and phrases. The reversed position is used when the market "overextends" or "hits a brick wall" ....."pick your expression" THEN ends up returning to where it started. In that trade you're "expecting", "hoping", "wanting/needing" the market to reverse, meanwhile, you hold a solid position without scaling in and out. It's a "Get in, Hold and Reverse" trade. Hehehehe. The kicker is, you "don't know for sure" what will happen. OOOOOOOOH. So there's a little nail-biting going on.

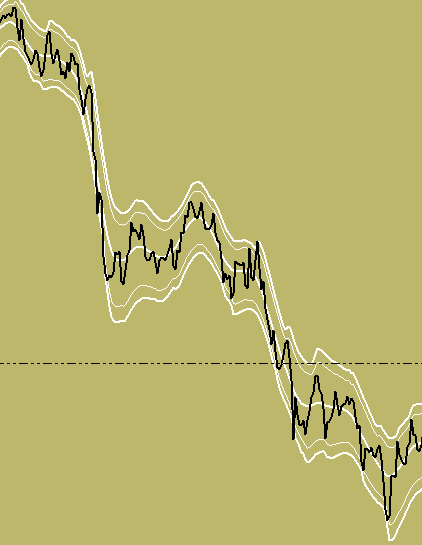

So where does the trailing stoploss idea come in? If you do enough research you will find a looooong list of "best trailing stop strategies" online. Many people I have come across are too clunky and robotic about the HOW.

Q = If I can save $1 today on a trade that is "expected" to return 5 or 10, BUT, could also have me lose that same amount OR MORE, should I save that $1? OR, should I TRY and determine "what the market is going to do next" so I can (eg.) move my stop to breakeven?

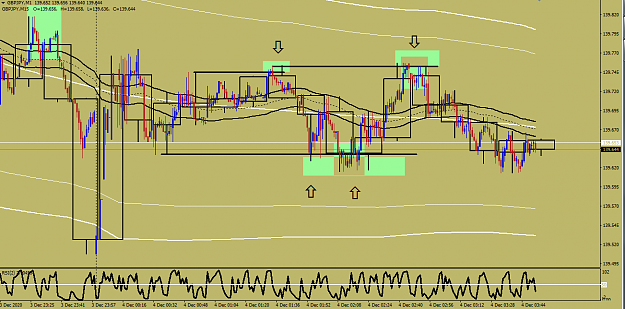

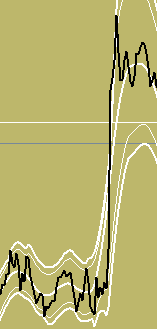

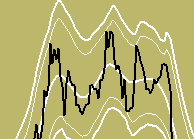

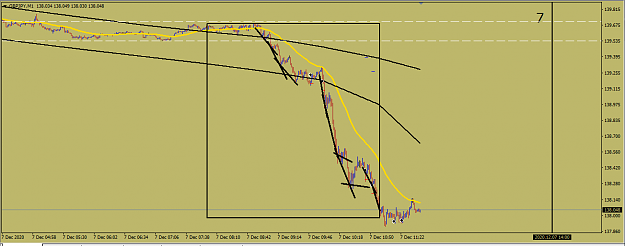

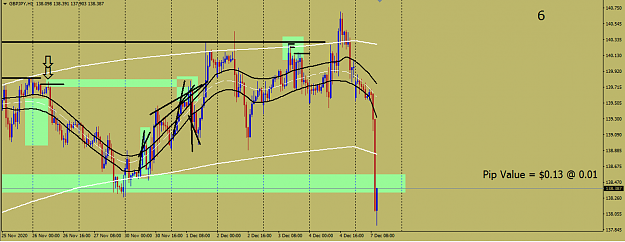

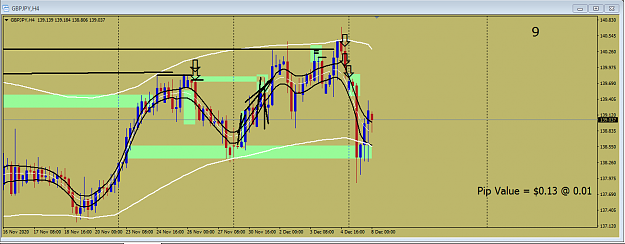

For me, there is no breakeven. If I am doing that, I am not confident about the trade setup and should NOT be there. Instead I like to use a "one potato, two potato, three potato" approach. Eg - The market moves AT LEAST 40% of my expected return BASED ON STRUCTURE, not fibs or a magic spell, then I will shift my stoploss NO MORE THAN 10%. For example, The goal is 50PIPS. It makes it to 20PIPS. 20/10% = 2PIPS shift. Either it's a reversal OR it's a breakout. PERIOD. Do I scale in? If needed. BUT it always always comes back to "what is the trade/trade setup? If you cannot answer this simple question, then I suggest you rethink your thinking towards your strategy OR take up knitting. Hehehehe. Below is a pic to help visualize all this.

Hope that helps.

Peter

So it got me thinking. What WAS my favorite way to trail that damn stoploss? I use the "first hit is my fault, second hit is their undoing" strategy. I suppose you've come across R's. And R:R. So if you haven't here goes ... you want to place a trade. You can afford a 10PIP stoploss for a move with the potential of triple return. That equates to = 10:30 approx. Risk 10 to make 30. And we''ll say this is gross return, before transaction costs. However, there's the other way to do this = 3:1 .... 30:10. Why reversed? Sometimes the market backs itself into a "corner" and has to claw at the situation to get away. And if you watch the 1 MINUTE chart at any length, you'll sometimes see the market initially make a great move up or down into that zone making numerous very high or very low points bunched or maybe spread out, within a certain "price zone". Some call it congestion, some call it other things.

(UNLESS YOU are the driver of that market you are watching, truthfully you have little chance of knowing for certain the WHY. BUT, you CAN summize by evaluating lots and lots of situations where this is happening in the same kind of way. And THIS is HOW you learn to trade properly. Repetition WITHIN a market's view but WITHOUT a story to deceive you. You are a trader so you have to be truthful. YOUR goal is to sort out fact from fiction to the very best of your ability.)

So why risk more than you might make? Although the market you trade may seem like a psychopath going all over the place at times, it does possess a sense of Rhythm and order. I am aware that some people have started trying to take advantage of things like the Oanda Order book and the order book concept in general. In my experience these things are false gods. They do more harm than good. They aren't really a blueprint, they merely have people become addicted and very dependent on an outside "tool" rather than relying on themself. So what does all this have to do with a reversed trade risk position? The people who try and take advantage of order book data are trying to "see into" the situation I mentioned earlier about the market cornering itself. It's to do with "Order Flow" and the fluidity of the market. Although most people complicate it far too much, in my opinion. And "Price action", Oh, you gotta love all these buzzwords and phrases. The reversed position is used when the market "overextends" or "hits a brick wall" ....."pick your expression" THEN ends up returning to where it started. In that trade you're "expecting", "hoping", "wanting/needing" the market to reverse, meanwhile, you hold a solid position without scaling in and out. It's a "Get in, Hold and Reverse" trade. Hehehehe. The kicker is, you "don't know for sure" what will happen. OOOOOOOOH. So there's a little nail-biting going on.

So where does the trailing stoploss idea come in? If you do enough research you will find a looooong list of "best trailing stop strategies" online. Many people I have come across are too clunky and robotic about the HOW.

Q = If I can save $1 today on a trade that is "expected" to return 5 or 10, BUT, could also have me lose that same amount OR MORE, should I save that $1? OR, should I TRY and determine "what the market is going to do next" so I can (eg.) move my stop to breakeven?

For me, there is no breakeven. If I am doing that, I am not confident about the trade setup and should NOT be there. Instead I like to use a "one potato, two potato, three potato" approach. Eg - The market moves AT LEAST 40% of my expected return BASED ON STRUCTURE, not fibs or a magic spell, then I will shift my stoploss NO MORE THAN 10%. For example, The goal is 50PIPS. It makes it to 20PIPS. 20/10% = 2PIPS shift. Either it's a reversal OR it's a breakout. PERIOD. Do I scale in? If needed. BUT it always always comes back to "what is the trade/trade setup? If you cannot answer this simple question, then I suggest you rethink your thinking towards your strategy OR take up knitting. Hehehehe. Below is a pic to help visualize all this.

Hope that helps.

Peter

Real Trading is not gambling.

2