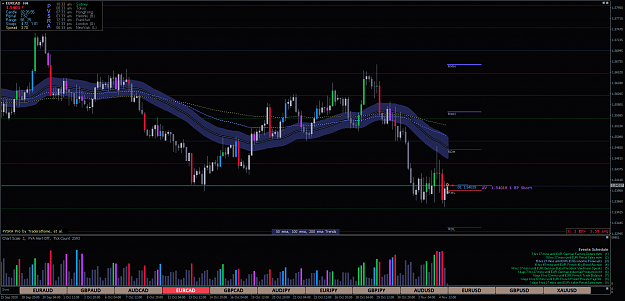

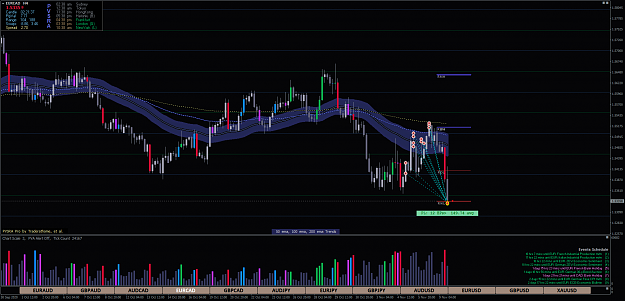

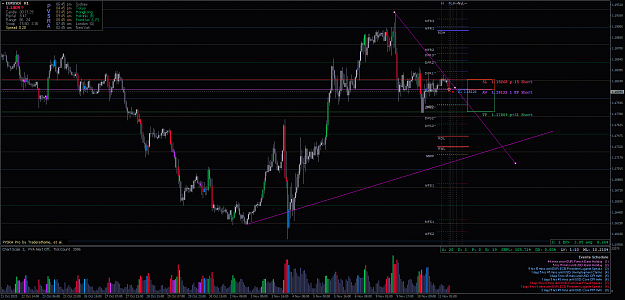

GBPCAD Short Trade

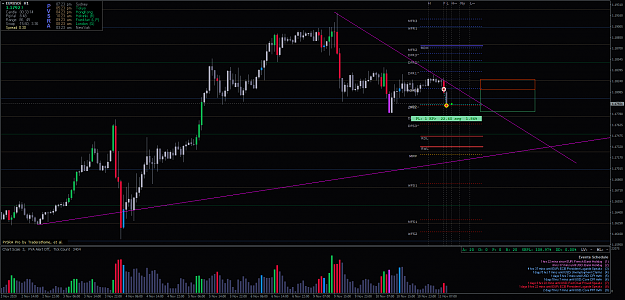

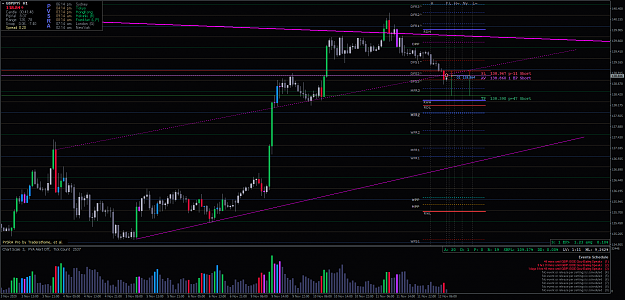

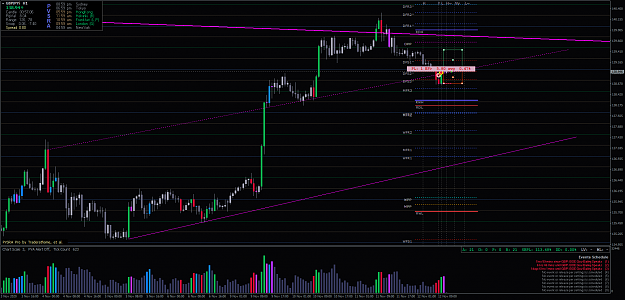

This trade is based on the H1 chart. About mid-way between LO and NYO the MMs had pushed price back up above a half level, with trends still stacked bearish and with slight down angle in spite of the pump. PVSRA shows the market loved the previous pump to the whole level above (bears distributing). This push back up was a FR 61.8% retrace of the dive from that whole level and most likely a stop hunt move up for more distributing....

This trade is based on the H1 chart. About mid-way between LO and NYO the MMs had pushed price back up above a half level, with trends still stacked bearish and with slight down angle in spite of the pump. PVSRA shows the market loved the previous pump to the whole level above (bears distributing). This push back up was a FR 61.8% retrace of the dive from that whole level and most likely a stop hunt move up for more distributing....

3